In the world of finance, you need confidence. Without it, you’re paralyzed but too much of it amplifies errors and undermines financial progress.

Better decisions can be the difference between financial success and ruin. I’ve written frequently about how human psychology often plays a significant role, leading to cognitive errors that cloud judgment. I write about it because I’m just as vulnerable as anyone else.

Among these psychological traps, overconfidence stands out as a particularly formidable foe, exacerbating other cognitive biases and amplifying the risks associated with financial decision-making. In fact, if you don’t think you’re vulnerable to cognitive errors, there is a 100% chance you have an overconfidence problem.

In this blog post, we delve into the concept of overconfidence and explore how it intertwines with other cognitive errors. This is essential to understand if we are to avoid the havoc it can cause with our investments.

Understanding Overconfidence

Overconfidence, a phenomenon widely observed in human behaviour, refers to an inflated sense of one’s abilities, knowledge, or predictions. It is the conviction that we are better informed, more skilled, and less prone to failure than we actually are. This cognitive bias often leads individuals to underestimate risks and overestimate potential gains, creating a dangerous mix in financial decision-making.

Confirmation Bias: Selective Perception at Play

When overconfidence couples with confirmation bias, a powerful duo emerges. Confirmation bias is the tendency to seek, interpret, and remember information that confirms preexisting beliefs, disregarding contradictory evidence.

In the financial realm, this combination can lead investors to become entrenched in their positions and overlook red flags that could impact their investments negatively. Instead of making well-informed choices, they might only pay attention to data that supports their overly optimistic outlook, leading to potential financial losses.

Confirmation bias is one of the most pervasive and insidious cognitive biases and overconfidence makes it particularly sticky.

The Illusion of Control

The illusion of control, another cognitive error, intertwines closely with overconfidence. This bias leads individuals to believe they have more control over events than they genuinely do.

In finance, this can manifest in traders who think they can control their investment returns by predicting market movements with precision. As a result, they may engage in excessive trading, succumbing to the illusion that they can outsmart the market. This tendency can lead to increased transaction costs and lower returns, as they overestimate their ability to beat the market consistently.

We control our process, not our outcomes.

Anchoring Bias: Trapped in the Past

Anchoring bias occurs when individuals rely too much on initial pieces of information and too little on subsequent data when making decisions – even when the later data is as or more relevant than our first impressions.

When coupled with overconfidence, this bias can lead investors to anchor their beliefs to past successes or failures, despite changes in the financial landscape.

Many of us have a hard time selling stocks that have gone down in price even when they no longer fit our investment plan because we’re waiting to “break-even”. This is an example of anchoring on the initial purchase price – a completely arbitrary number – at the expense of following a rational investment process.

We all have a tendency to anchor but overconfidence can cause our anchors to get stuck. The unwillingness to adjust strategies and make decisions based on current data could result in significant financial losses.

Over-Optimism and Risk Assessment

Overconfidence often breeds excessive optimism, leading to a skewed perception of risks associated with financial decisions.

I recently had a client who had 70% of his portfolio invested in one company. He was so convinced that the great returns he had enjoyed up until that point would continue that he had borrowed over $100,000 dollars to buy more of this stock. Even when faced with his wife’s concerns about the numerous risks associated with this strategy, which I laid out in detail, he was still unwilling to budge.

Overconfidence can cause investors to become overzealous about the prospects of a particular investment, underestimating potential downsides or overestimating potential returns. This tendency can make them more willing to take on risky ventures, disregarding the importance of diversification and risk management.

Loss Aversion: The Fear of Failure

Loss aversion, the inclination to feel the pain of losses more intensely than the pleasure of gains, combines with overconfidence to create a paradoxical situation. Overconfident investors might be less cautious when faced with potential losses, as they believe they can recover from any setback with their superior decision-making abilities. Consequently, they might hold on to failing investments longer than necessary, hoping for a turnaround that may never come, leading to more significant losses in the end.

Conclusion

Overconfidence, with its ability to amplify other cognitive errors, poses a significant challenge to effective financial decision-making. As investors, understanding these psychological traps and acknowledging our own biases is crucial. Striving for humility, learning from past mistakes, and remaining open to alternative viewpoints are vital steps in mitigating the detrimental effects of overconfidence.

In the world of finance, success requires a balanced approach, where a realistic assessment of risks and rewards guides decision-making. By being aware of the potential dangers of overconfidence, we can develop a more prudent and informed strategy, ultimately improving our financial outcomes and achieving long-term success.

Thank you so much to those of you who have chosen to support me and this blog with your donations. Your generosity has a huge impact on the quality of this site. If you are so inclined, no matter the amount, you can support this site by clicking here:

Part of the over confidence outlook may be fostered in childhood from well meaning parents, teachers and coaches. Instilled in us that this is a good quality.

That is a really interesting point, Eve. What do you think is the message kids are receiving that might lead to overconfidence?

I read in the Financial Post today about two kinds of inflation by Tom Pickering, “demand push inflation” and “cost push inflation “. Raising interest rates can reduce semand put inflation, but not cost put inflation in. commodities. Pickering recommend investments in products with direct investments in commodities, but not resources companies. What does he mean saying “products ” invested in resource companies? ETF’S?

I didn’t read the article, so can’t really answer your question. Perhaps another reader will chime in.

But here is a list of things no one is good at predicting: stock prices, interest rate changes, inflation. Sure, there are trends, but making investment decisions based on predictions is hubris – he is basically declaring that he is smarter than the market (overconfidence). Experience has taught me to ignore this kind of investment advice.

Great article Matt!

Thank you, Mike!

This reminds me of the need to build in some margin of safety when making decisions. Accept the fact that you’re very likely not always going to be right. In fact, it seems to me often that the opposite of the expected often happens! I have dealt with overly confident arrogant advisors who conned you into believing they could predict the future with some certainty. Annoying.

Excellent, Sil – you took it to the next level with this comment about building in a margin of safety . . . “I think I’m right, but in case I’m not, how can I protect myself?” To me, this is the fundamental argument for diversification: never have more in one investment than you can afford to lose without it affecting your lifestyle.

Hi Matt — Very pleased to see that those intrusive ads have disappeared. I hope readers realize that making this change reduces your income and makes it more expensive to operate this blog. I hope they will consider upping their contributions to help bridge the gap. Dave

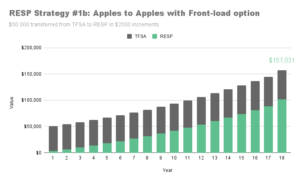

If the btsx strategy in its most basic form involves buying and selling at only one time throughout the year would most individuals produce an even greater return by putting their paychecks into another investment until they are ready to buy and sell?

For example. I buy and sell all my stocks Jan 1 every year. I’m able to invest 10,000 a month but instead of putting it into a chequing account I buy CASH.TO which offers a reasonable yield and great security. Are there any issues with my strategy?

Definitely don’t wait. The sooner you get our money invested the better. I have found that building up cash (or an ETF like CASH.TO) can make it difficult to stick to an investment plan, so I tend to simply buy a broad-based index ETF with monthly funds. Everything gets rebalanaced and organized with my annual review.

I wrote about this and more here: https://dividendstrategy.ca/how-to-use-btsx-in-real-life/

Thanks matt!