There is no shortage of investment blogs. You even have your choice of Canadian blogs focusing on dividend paying stocks. What makes dividendstrategy.ca special? Beating the TSX. There is no other simple, freely accessible investing method out there that can match the 30-year performance record of BTSX – and I’m proud that this is the place where investors of all stripes can come for all things BTSX-related.

But sometimes information about the method, past performance, and current portfolio are not enough. Over the last two years readers have posed some good questions; requesting additional information to help them get started with BTSX or to clarify some functional aspects of putting BTSX into action. In this post I am going to answer the top five reader questions about BTSX.

1. Aren’t you worried that Stock X on the list has (insert flaw here)? Shouldn’t the method be changed to avoid these stocks?

In last month’s post, I laid out a few reasons why I don’t necessarily buy every stock that appears on the BTSX list, but there are many more factors that strike fear into the hearts of potential investors. These are the most common questions I receive about BTSX.

“The payout ratio of Stock X is 90% – surely this would be a bad investment. Why don’t you change BTSX to eliminate companies with payout ratios over 70%?”

“The PE ratio of Stock Y is 50 – clearly it is overvalued. Why don’t you change BTSX to eliminate companies with PE’s over 25?”

“Stock Z has an inconsistent dividend history. Why don’t you change BTSX to only include companies who haven’t decreased their dividends in the last 10 years?”

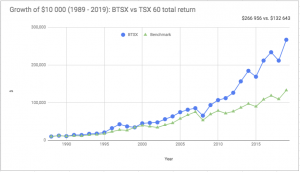

These are all fair points and important considerations when deciding what stocks to include in your own personal portfolio. No one should make investments they are not comfortable holding for the long term. But it’s important to remember that the results of Beating the TSX – average annual returns of 12%+ over the last 30 years – are based on a simple, repeatable method that has remained essentially unchanged over those decades. Would an alternate method do better? Maybe. But adding criteria to our methodology now would both pollute the transparency of our process and make it less accessible to the average DIY investor.

So, no, I am not going to change BTSX. BUT, if anyone is willing to compile the data and send it along to me, I would be happy to consider including BTSX variations on this blog.

2. How do you deal with dividend cuts?

Every now and then one of our stocks will cut its dividend. This is painful because it is almost always accompanied by a severe drop in price as well – a double-whammy. But we have to remember that the long term performance of Beating the TSX has included these unfortunate events. No one ever said the system was perfect, but it’s been “perfect enough” to beat the index by almost 3% per year for the last 30 years.

Do I sell a stock as soon as it cuts its dividend? I don’t for two reasons. First, I don’t like to check my portfolio on a daily basis to be on top of these things; the evidence is clear that checking our portfolios frequently leads to bad decision making. Besides, one of the advantages of BTSX is that it is low maintenance.

Second, my observation is that by the time the dividend cut is announced, the stock price has already tanked. Sometimes the announcement is even met with enthusiasm by investors who bid the price up. Even though the evidence is clear that dividend cutters under-perform dividend-payers and growers, it is unclear to me that timing the decision to sell on the announcement of the cut is a profitable strategy.

3. How do you think Beating the TSX will perform in the future?

I think it is important to be conservative and humble when projecting into the future. When I am helping people with their financial planning, I give them projections based on 6%, 8% and 10% rates of return. I don’t anticipate that the economies of the world will grow at the rates we’ve seen over the last 30 years, so it seems unlikely that BTSX will maintain an average rate of return of over 12% as it has done until now. Somewhere between 8-10% for the stock portion of a dividend-based portfolio seems reasonable.

Will dividend paying stocks continue to out-perform? I see no reason to believe they won’t. The profitability of dividend paying and growing stocks is not a trend but a very long term feature of stock markets (here is the Canadian evidence). It makes sense to me that large, profitable companies who share those profits with shareholders will continue to be better investments than smaller, more vulnerable ventures with much higher rates of failure.

4. What have been the maximum drawdowns for BTSX in any given year? Biggest gain? Average gain?

Our data for the BTSX method go back all the way to 1987 (thank you David Stanley). Since then the worst year was 2008 with a -23.3% rate of return. The benchmark index also had it’s worst year in 2008 dropping 29.4%.

The best year for BTSX was 1996 with a gain of 54.9%. The best year for the index was also 1996 with a gain of 31.9%.

Over the last 30 years, the average annual return for Beating the TSX has been 12.5%, while the benchmark index has averaged 9.7% (as of the end of last year).

What does this data suggest? Beating the TSX has dropped less than the index in bad years and risen more than the index in good years, on average beating the index returns by about 30%.

5. Do you have any book or blog recommendations?

I read about investing and personal finance all the time. Here are some of the most worthwhile resources I have come across:

Books

A Random Walk Down Wall Street by Burton Malkiel – to convince us that stock picking and market timing are bad ideas

Stocks for the Long Run by Jeremy Siegel – to remind us that stocks have been, and will continue to be, superior investments

Thinking Fast and Slow by Daniel Kahneman – one of my top 5 books of all time; we are fooled all-the-time – and we usually do it to ourselves

The Strategic Dividend Investor by Daniel Peris – a clear and concise explanation of why a dividend-based investment approach works

Blogs

The Collaborative Fund blog (Morgan Housel) – brilliant

A Wealth of Common Sense (Ben Carlson) – check out his podcast with Michael Batnick, called Animal Spirits

Of Dollars and Data (Nick Maggiuli) – deep dives into relevant topics

Humble Dollar (Jonathan Clements, et al.) – his book, How to Think About Money, is also great

As always, I hope this content is helpful. Feel free to let me know in the comments

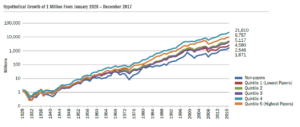

1. On a page entitled ‘BTSX results A 30-year track record’ there is a table which shows the XIU (which is the substitute for tracking the TSX/60 Index) gaining an average from 1986 to the end of 2018 of 9.40% per year while on a page entitled “The Power of Dividends” there is a table with a vertical column coloured ‘Green’ the S&P/TSX Composite Index is shown as having gained 5.9 % per year. Why are the results of the S&P/TSX shown rather than the XIU (the proxy for the TSX/60) results for the same time frame? I thought the benchmark is (was) the TSX/6O (XIU) and not the S&P/TSX. What am I missing or misunderstanding?

2. On the same page entitled ‘The Power of Dividends” a vertical column shows ‘Dividend Growers’ having a return from 1986 to 2019 of 11.10% and of ‘Dividend Payers’ having a return of 9.20%. Is there a list available which sets out the symbols or names of the stocks that made up the ‘Dividend Growers’ and the ‘Dividend Payers’ during those years?

I would appreciate very much receiving your responses to these questions. If my questions are confusing or you require more information, please do not hesitate to call me.

BTW, three men whose views and opinions and writings I value highly and have for some time are David Stanley, Tom Connolly and Henry Mah. Henry’s most recent book is a great book for any beginning or even veteran dividend investor, in my opinion.

I’ve heard good things about Henry Mah’s book – I just haven’t read it myself. Thanks for the recommendation, I’ll put it on my list.

As for your questions, they both pertain to “The Power of Dividends” document which is published by RBC Global Asset Management, not me, so I don’t have access to their raw data. Obviously their data processing differs a little from mine, but the important point for Canadian DIY investors is that an independent reputable source has also found the evidence to be in favour of dividend investing.

One particular question I was looking for an answer to is regarding the annual re-balancing of the portfolio in an non-registered account:

Can you recommend a strategy/formula that can be used to try to balance triggering the realization of capital gains versus keeping a lower performing dividend payer and not realizing the capital gain?

This is my first year with the BTSX strategy and one of the challenges I will have is when it’s time to rebalance the portfolio I may trigger a capital gain. Should I let a stock ride if it’s not “too far down the list”?

I don’t have this concern with my TFSA or my RSP but I have a sizable amount of money outside of those with no contribution room available.

Obviously tax brackets and other factors weigh in to my personal decision, but I’m wondering if you can propose a mathematical approach to help this decision process?

I don’t mean to dodge this question, but I think it would be a mistake to attempt an answer. This is essentially a question about taxation and should be directed to your accountant whose job it is to understand the details of your particular financial situation. Having said that, I think it is generally a bad idea to let capital gains tax prevent us from selling poor investments.

I use more than one investment strategy. Some investors including myself buy Brookfield Property Partners LP (BPY.UN) outside the “Beat the TSX” strategy in order to park cash.

Roger L

More than one investment strategy? – fair game.

BPY.UN as a place to “park cash”? – I fail to see the logic.

BTSX is a great strategy for investing. I have been investing and building a dividend portfolio for the last 20 years and have averaged 11.47% annually (before I knew about BTSX)to the end of 2019. I think especially for new investors and experienced ones as well, this is very good way to go. The question about re-balancing and triggering capital gains is fair, but we avoided most of it by investing in registered accounts. But when that is not possible and we have the same situation, I agree with you that you still make the trade and pay the tax. You will have to at some point anyway, or your heirs will.

Thanks for weighing-in DivInvestor.

I guess I should expand on my logic with regards to a previous comment I made when I said that I park funds in the BPY.UN stock outside my Beat the TSX strategy. My overall portfolio consist of investments solely in stocks, but I keep a portion in cash for potential investment opportunities that present themselves. However, outside the Beat the TSX strategy, very few buy opportunities have presented themselves this year in my view. All my tradings are carried out in accounts held by a discount broker who naturally pays no interest on my cash balance. I am not a day trader and don’t usually buy stocks for short periods of time. I could invest the cash balance in bonds or money markets but the funds are than locked-in for a fixed period of time, i.e. : 30 days, 90 days, etc.. I therefore buy such stock as BPY.UN solely for the purpose of the dividend payout. This approach allows me to sell the stock if I need the funds quickly to buy a stock for longer of time. I do take the risk that BPY.UN might drop in price suddenly but that is a risk I am willing to take.

Roger L

Different assets within our portfolios have different roles: growth, income, safety, etc. They have characteristics that suit those roles. It would be a good idea to look at the characteristics of BPY vs cash in light of the role you would like that money to play in your portfolio. They are very different.

Thanks for your work on this blog admin – very helpful to see the list of stocks and the details on the strategy. As I understand the BTSX strategy buys and sells once a year. One thing I haven’t seen addressed is what to do with monthly (or anytime) contributions to your investment. So if you are saving and collecting dividends (not dripped) you will spend a fair bit of time with that capital not invested in the market. Ignoring trading fees as with low/no-cost purchasing with Wealthsimple available to Canadians there is no trading cost to buying a few shares each month what does the strategy say about this capital?

Does one continue to buy from the January list, or buy new entries to the continually updated list? Are there are studies done on this strategy?

Thanks again, and looking forward to your reply

I now see your post on How to use BTSX in real life ! That is what I was looking for – thank you.

https://dividendstrategy.ca/how-to-use-btsx-in-real-life/

I would still like to know if any work been done on investing in the index funds as you say, or continuing to add to the BTSX portfolio?

Hi Jason, thanks for the comments.

Glad you found that post useful. Here is another more recent one that might help further: https://dividendstrategy.ca/using-btsx-to-build-your-portfolio-a-step-by-step-guide/

With respect to your question about buying index funds or more BTSX stocks between annual updates, that’s really a personal choice. BTSX is a tool, and we all use it a little differently.

Hope that helps, Jason.