As I write these words, the TSX Composite is down 11.2% in the last week – officially a market correction. News headlines are screaming that it’s the fastest sell-off in history. The talking heads on BNN are turning shades of green, warning that this might be “the big one”. How are you feeling about your investments?

No one knows how this is going to turn out – expert or not, they’re all just guessing. Some will guess right and feel validated; some will guess wrong and regret it. Others understand there’s no point in guessing.

Welcome to your stress test

These events are historic – another serration on that jagged chart of stock market performance we’ve gazed at so many times. How noticeable it will be in the end remains to be seen. But it is a learning experience nonetheless, a stress-test of our investment plans.

I know people who are so jacked up with anxiety that they can barely sleep, their index fingers quivering over their computer mouse, agonizing over whether to sell everything. Others shrug off the news, drink their coffee, and start that novel they’ve wanted to read since Christmas. Same market news. Different reactions.

If you find yourself taking this correction calmly and dispassionately, congratulations: you followed the advice of many wise investors (and this blog) and created an investment plan that was rational and suited to your temperament. If you are more like the anxious insomniac obsessing about selling for fear of losing more, well, let’s just call this an opportunity to make things right. To adapt a well known investing axiom: the best time to make an investment plan was yesterday; the second best time is now.

How did you prepare for the wild times?

To be fair, how you feel about market corrections depends on more than whether or not you have a plan. Perhaps Morgan Housel said it best in a piece he wrote in 2018:

There are two ways to prepare for wild times: You can expect them to come, or you can predict when they’ll come. The former is realizing that throughout your career things will occasionally get wild (“Expect about two recessions per decade, on average.”) The latter is predicting that things will get wild at a specific time (“A recession is coming this year.”) The former isn’t hard and helps, latter is extremely difficult and often backfires.

Morgan Housel, Collaborative Fund

Have you really accepted that you can’t predict the market or, deep down, in your heart of hearts, are you still justifying some undiscovered market timing skill?

Top 5 things not to do during a market correction

As bad as this correction may feel, there are all kinds of ways investors can make it worse.

Ben Carlson wrote a great piece on things that won’t help you during a market correction. I will paraphrase here:

- Go to cash. Maybe you had too much money in the market before the correction, but that doesn’t mean 100% cash is right either. Extreme times don’t call for extreme measures, they call for moderation. And if selling now is hard, don’t forget you are also going to have to figure out when to buy back in – and that is much much harder.

- Beat yourself up. Markets look easy in hindsight. Every investor has weaknesses. We can’t control the markets, but we can control our investing process. Forgive yourself, put together a plan that you can live with through ups and downs, then ride it out. We’re all losing money (temporarily) – join the club and exercise a little patience.

- Engage in technical analysis. The enduring allure of charts and their siren song of market prediction is a sad and wonderful example of how gullible we are. When you’re on your heels flailing around for a financial handhold, it can be tempting indeed to reassure ourselves with a little pattern recognition. Don’t fool yourself. Technical analysis is a game, not an investment strategy.

- Adopt a short-term strategy to profit from the coming crash. We are wired to escape pain and financial pain is no exception. Studies show that discomfort leads to cognitive interference: we don’t think straight. Now is not the time to rush into options trading, buying the dips or go treasure hunting for the next ten-banger. It’s hard to do when emotions are running high, but what you need is a long term strategy, not a quick fix.

- Start trading based on the financial news. Think you can get ahead of the pain by reacting to the latest headlines or analyst report? Think again. That news is already baked into the price. In times of uncertainty, we seek leadership, someone to shine a light so that we can understand and control, even just a little, the randomness that batters us. Bad news: they don’t know any better than we do.

Some practical advice

Now that we’ve covered what not to do, here’s a little advice. If a 10-20% drop makes you question your investment strategy, it was not the right strategy for you. Don’t wait, fix it now.

But remember that in times of stress it is harder to make sound decisions. There are people all over the world making all of those mistakes and more, thinking they are “fixing” a problem. In time, most of them will have made things worse. It can be tempting to over-complicate the situation, but my advice is to steer toward simple.

- Were you stock picking even though you knew you shouldn’t? Stop. Now is a good time to adopt a rules-based approach (like BTSX or low cost index ETFs).

- Were you trying to time the market? Accept that you can’t and do what you always knew was right anyway: buy and hold.

- Did you have too much money in the stock market and not enough in cash/bonds? Now that you have a better idea of your volatility tolerance, adopt an asset allocation that makes sense for you.

BTSX: a solid game plan

It is what we do during times like these that has the greatest impact on our lifetime wealth. Don’t let market volatility lead to emotional volatility. If you have a good plan, the best thing to do is nothing.

This isn’t the end of the game; just one play among many. Elite athletes don’t change their game plan every time the other team scores; they focus on their process. So should we.

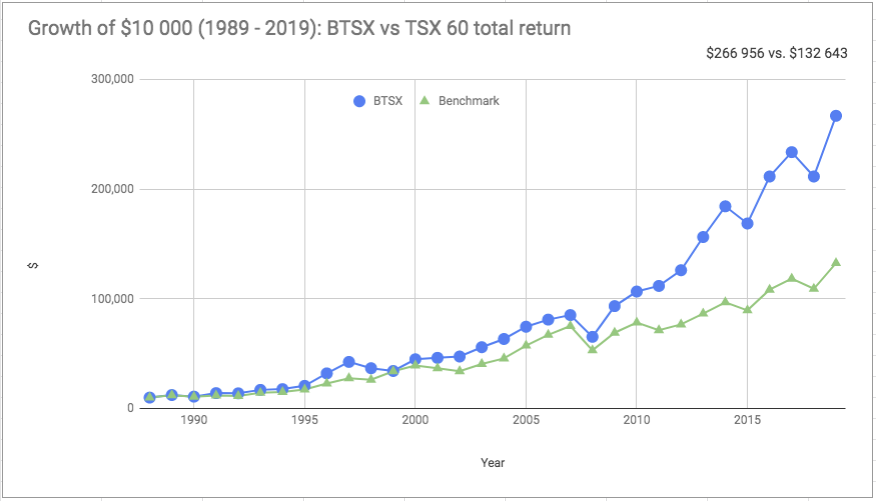

Don’t aim for perfection. Being consistently ‘good enough’ is a much more reliable strategy. Beating the TSX has not been immune to market corrections, but as you can see from this chart, it has certainly been good enough.

BTSX March 2020 portfolio

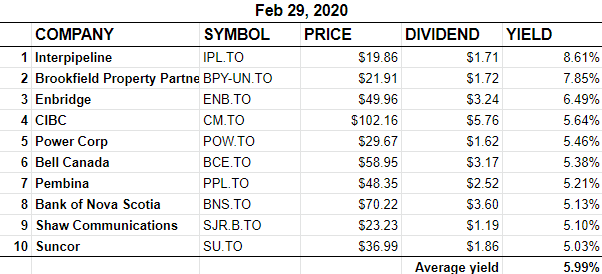

Here are the top ten yielding stocks of the TSX 60 – the BTSX portfolio for March 2020. To be clear, this is to help those who are constructing a long term portfolio, not a suggestion to re-jig our portfolios monthly.

As you can see, even in these challenging times, the benefits of Beating the TSX are already becoming apparent. First, recent price declines have popped our average yield up to 6%. Second, multiple companies that are either on the list or have been recently have announced dividend increases including TD, RY, MFC, TRP, and SU. Remember: BTSX stocks tend to display less volatility than the markets as a whole and tend to perform relatively well when the scales tip toward fear from enthusiasm.

Hi, thanks for your update during these tumultuous times. I don’t currently use the BTX strategy but if I had, I would feel comfortable in still receiving my “increasing” dividend income while the market sorts itself out and wait until my principal returned to it’s baseline.

One question I have is what are your thoughts on a couple of these stocks that have a payout ratio above 100%. What are your thoughts on their riskiness for inclusion.

Thanks in advance, Terry

A growing income stream from dividends is not just practical in a real-world sense (putting food on the table and Netflix on the TV), it is also has beneficial behavioral effects, decreasing the urge to make rash decisions.

Re payout ratios: yes, they are a concern, but BTSX has never used the payout ratio as a criteria and I think the long term results speak for themselves. I simply don’t have the data to confirm that excluding these stocks would lead to superior returns, although it would be an interesting side project. It is also possible that the prices of these stocks are so depressed that, on average, they make even better investments.

I just noticed Suncor has become part of the BTSX list. I would appreciate your subscribers comments on this.

I guess my concern with this stock is the anti oil stance of the federal government even though we own a pipeline. The dividend while we wait is nice and I like the company.

I appreciate all your work Matt on the site and everybody’s input!

So far last week, I absorbed a 6.8% hit on my overall portfolio. I will not lose sleep over this correction. I will not modify my investment strategies. I have a fair amount of cash on hand waiting to be invested. This market correction will offer me opportunities to invest some of that cash. Have a good day and keep up the excellent comments.

Indeed, if one were lucky enough to have had a million dollars invested in the BTX plan prior to the latest market drop, and was happy with the annual dividend income from that, then they would not have reason to worry about the drop, especially with the annual dividend increases that take place with solid companies.

Unless I am missing something, I see having having a portfolio of 100% solid dividend paying stocks as one of the safest portfolios you can have without the worry of your principal running out in retirement. I know this goes against practically everything you read about portfolio construction with bond/stock breakdowns but AM I WRONG?

Terry

No, I don’t think you are wrong. In my opinion BTSX provides the best retirement plan possible:

1) No matter what the market does I still get my dividend cheques in the mail (metaphorically).

2. I get significant yearly increases that so far have outstripped the inflation index.

3. I pay less tax on this income than if it was from bonds, GIC’s, etc.

I have followed your columns in CanadianMoneysaver for years and have always appreciated you comments and insights. However, I have two questions. Are you agreeing with Terry that having a portfolio that is 100% invested in dividend paying stocks is the right thing to do even for retirees who are 70 or 80 years of age? If so, would you still have cash in a savings account or would all you investable assets be 100 % in dividend paying stocks.

Here’s my 2 cents: Although it’s tempting believe there is a “one size fits all” solution to our investment woes, we should recognize that different situations and temperaments necessitate different approaches. A 100% dividend-paying stock portfolio might be appropriate for investors who have the following characteristics:

– living expenses are fully covered by dividends (+ CCP, OAS)

– no large expenses expected within the next 5 years that would require selling stocks

– the temperament to not panic during a stock market crash

This last point is the most important. Diversification among asset classes doesn’t just smooth out volatility; it allows many investors to keep their heads during the wild times. This gives many people a behavioural advantage that far outweighs a small mathematical negative effect on performance.

This is why financial plans must be individualized.

I agree with Matt. You see very different answers to this question on U.S. blogs. I think as seniors we sometimes fail to appreciate that our health plan eliminates most (but maybe not all) big health expenses during retirement. Our southern cousins who tend to brag about their lower taxes conveniently ignore what can happen to nest eggs if a bad health situation arises. So, much easier to be 100% in dividend stocks if you are not concerned about major health expenditures.

And, I would add the proviso that the stocks are of the blue-chip, TURF variety with a long record of rising dividends.

As de facto consumers of online financial information, it’s a useful observation that sound advice may be different depending on what side of the border you live on.

I also agree with Mr. Stanley. We are 100% in dividend paying equities and retired. The dividends are our income and we don’t need to sell anything. This does go against all conventional advise, but why not assess your own situation and go unconventional. This has worked well so far and we will stick with this plan even in this market.

I’m with Terry and the posters who are in the dividend payers camp although I prefer ETF’s to aid in diversification. I don’t have any more than 10% of my overall holdings in one fund.

I’m retired and living off my dividends and while it was a bad week (I was down 6.3%) I’m not concerned as my I’m still up overall because my dividends have averaged 4.75% over the past 2 years and they pay me $3956/month.

If I was still an index investor with laddered GIC’s for living expenses I would be very concerned with having to sell any of my investments in a down market. That’s why I switched to dividend investing over 2 years ago when I retired.

The only individual stock I own is BPY.UN and while it’s down 7% since I bought it in January it pays such a large dividend it’s OK.

Great article Matt and very timely. I have come to the conclusion that half of the investing process is the technical stuff, one’s investment plan, what stocks to buy, self education, etc. The other half of the game is the emotional side. It is only when the market gets really hot or really drops does an investor has the opportunity to see where they are actually at in terms of emotional control. BTSX really helps to guide an investor’s actions in the right direction but we need to each be coaching ourselves to be in the right frame of mind. I have always said that when my children started investing they had the emotional side under control. They didn’t pay attention to the ups and downs in the markets at all as they didn’t watch the news much. After one particularly bad day in the market, my oldest daughter said, “I heard that the stock market was down a lot today. Are there any stocks I should buy?” I almost teared up as I knew she understood half of what was required to be a successful investor.

Ha ha, that’s great Ross – you raised a level-headed contrarian! When I started I thought investing success hinged on picking the big winners. Now I realize it’s the long term performance of the portfolio as a whole that matters, not individual stocks, not short term volatility. The best way to achieve my financial goals is to get out of my own way and let BTSX do the work.

It took me decades to figure out that there were 2 parameters in-play when I purchased a stock. First was the price at which I decided to buy and the second was how much of the stock to purchase. It does not help your overall portfolio if you commit 1% of your portfolio to a stock that doubles in value in a year. You are further a head if your overall portfolio advances at a more consistent 10% / year average. The other issue with chasing the big winners is that at some point you have to make a decision to sell it so you can invest in the next big thing. Two things can go wrong. One, you sell the first stock too earlier and miss gains, or you sell too late and lose some of the gains. Next you have to pick another big winner to replace that one. Unfortunately the odds are against us to consistently finding big winner after big winner. The path usually ends badly. Thus the dividend paying stocks are my choice now.

With the ‘oil’ correction adding to the ‘virus’ correction, do you have any comments for buying new BTSX stocks?

Hello, I’m a rookie investor and found your site from a google article. Based on BTSX to invest 100k starting jan 1 , would it be correct to invest 25k equally in the 10 highest dividend stocks as of Jan 1 and then another 25k at the beginning of the subsequent 3 quarters? Or do i invest all 100k on Jan 1 with no changes until 1 year later? I’m also not clear on where i find the top 10 dividend stock info. Thank you for sharing !

Hi Terry E, and welcome to the blog.

When it comes to using BTSX as a tool for dividend investing, the most important thing to understand is that it is just that, a tool. I track the data based on annual rebalancing as described here

https://dividendstrategy.ca/stock-selection-method/

. . . but there is no dogma saying this is how BTSX must be used for individual investors. This blog post might help you:

https://dividendstrategy.ca/is-it-a-good-time-to-invest-in-the-stock-market/

And this one:

https://dividendstrategy.ca/how-to-use-btsx-in-real-life/

The current list of top 10 yielding stocks can always be found here:

https://dividendstrategy.ca/btsx-portfolio/

Hope that helps.