We learned all about RESPs in our last post. Now comes the fun part: what is the best way to save in an RESP?

First, a quick review of the basic RESP rules.

RESP rules – the quick and dirty

- RESP contributions are made with after-tax dollars – i.e. unlike RRSPs, there is no tax deduction for RESP contributions

- The government will top-up contributions by 20%, up to a maximum of $500 per child per year. This is called the CESG (child education savings grant). Thus to maximize the CESG top-up, one must contribute $2500 in a given year.

- The lifetime maximum total CESG per child is $7200

- There is no annual contribution limit for RESPs, but there is a total limit of $ 50,000 per child

Given these features, we have a few options when saving in an RESP. For the following scenarios, we will assume a 6% rate of return. For all of the scenarios I am going to present, we will maximize our total contributions at $50 000 so that the comparisons are fair. You don’t have to do this. The purpose of these examples is to reveal what is likely the optimal RESP funding strategy, not a step-by-step action plan.

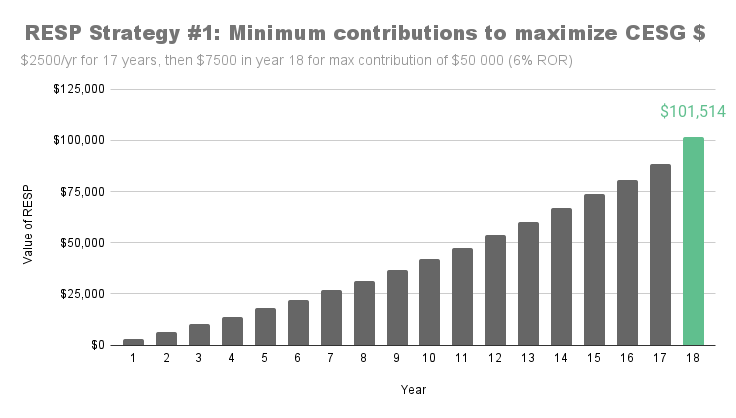

Strategy #1: Maximize the CESG

The first option, and perhaps the most intuitive strategy, is to contribute $2500 annually to the RESP. We’ll call this the “Maximize the CESG Strategy”. Note that to reach the $50k contribution limit, we will have to make a $7500 contribution in year 18.

As you can see, by the end of the eighteenth year, the RESP is worth $ 101,514. $ 50,000 of that amount came from contributions, $7200 from CESG, and $ 44,314 from investment income.

As you can see, by the end of the eighteenth year, the RESP is worth $ 101,514. $ 50,000 of that amount came from contributions, $7200 from CESG, and $ 44,314 from investment income.

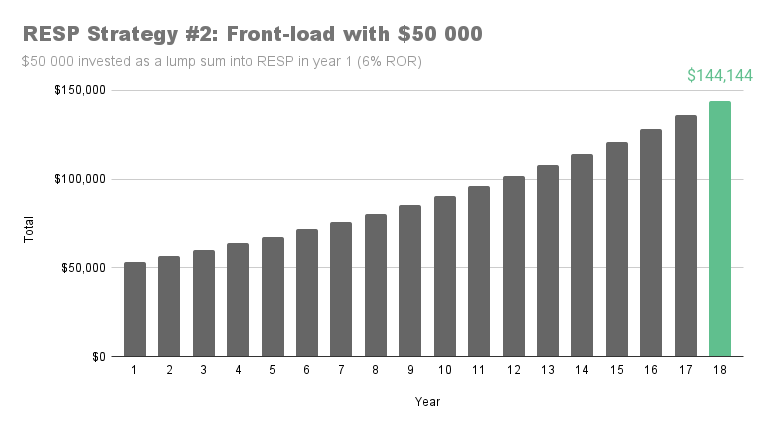

Strategy #2: Front-load with $50 000

But what if you had the option of contributing $50,000 all at once in the first year? You would only receive $500 in CESG, but all that money would have 18 full years of tax-free compounding growth. This is an alternative strategy that I’ve seen advocated in numerous places. Even though, for most people, it may not be feasible to access $50k all at once, if you could, does that mean you should? Let’s run the numbers.

Using this “front-loading” strategy, our RESP achieves a final balance of $144,144 – almost $43,000 more than strategy #1. $50,000 of that amount came from contributions, only $500 from CESG, and $93,644 from investment income.

So, we have our answer, right?

Not so fast. This is not an apples-to-apples comparison because it ignores the time value of the money we are not investing as a lump sum in Strategy #1. Let me explain . . .

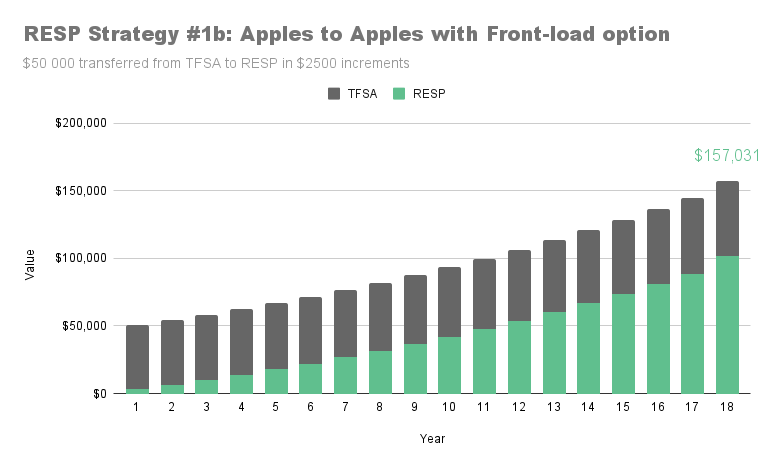

Apples to apples

To make a fair and accurate comparison, we need to think of it this way: Imagine you have $ 50,000 to contribute to an RESP, and let’s say it’s in your TFSA (you have been using your TFSA, right?). In the front-load strategy, it all goes into the RESP. In strategy #1, however, you withdraw $2500 from your TFSA annually and contribute it to the RESP.

But, here’s the important part: the $47,500 remainder stays in the TFSA and continues to earn investment returns. Assuming the same 6% rate of return that we’re getting in the RESP, that’s $2850 of investment income in year one – more than enough to cover the following year’s RESP contribution – and that investment income continues year after year.

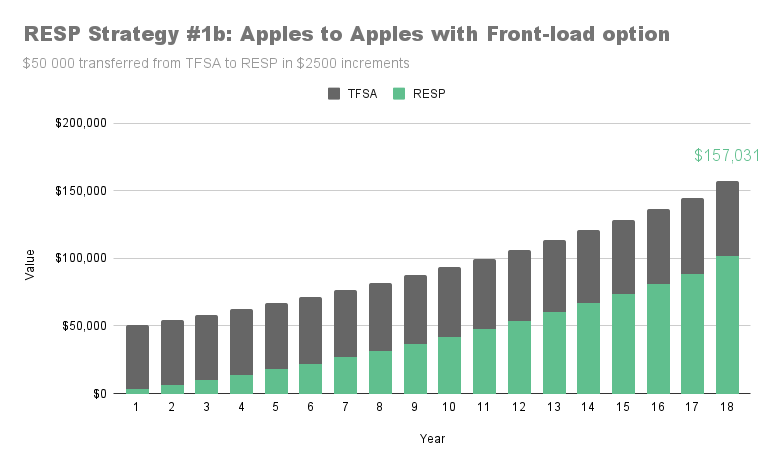

Thus, a fair comparison must consider the values of both accounts over 18 years. This is what Strategy #1 looks like taking the whole $50k into consideration:

As you can see, our total accumulated wealth is $ 157,031 – almost $ 13,000 more than the lump sum strategy. $101,514 of this is in the RESP, just like before, and $55,517 is in our TFSA (it is never depleted since the 6% investment returns are greater than the RESP contributions – at least until the last year when we made a $7500 contribution in order to max-out our contribution room). This reveals that the lump sum strategy is not likely to be optimal, particularly if funds are taken from a registered account like a TFSA.

When is front-loading a good option?

Interestingly, if funds are taken from a non-registered account rather than a TFSA for incremental RESP contributions, the front-loading approach may become more attractive. This is because money is being moved from a taxable account to a tax-deferred account as soon as possible.

To make this comparison, I ran the numbers for Strategy #1 again, using a 5% rather than 6% rate of return for the account that RESP contributions were drawn from to estimate the after-tax rate of return in the non-registered account.

The result is slightly less (about $1500) than the front-loading approach. Even though the difference is small, and there will be variability based on investment returns and tax rates, if one has significant non-registered money, it might make sense to front-load the RESP with a large lump sum. Just be aware that sequence of returns risk will play a big part in the final balance of the RESP.

What this reveals is the sensitivity of such strategies to the compounding effects of small numbers – over time, 1% annually makes a big difference. This is why investors need to be fastidious about minimizing fees.

Similarly, if one were to incur additional taxes in order to contribute a lump sum to an RESP, that would negate much or all of the advantages of the RESP. Another bad idea would be to contribute to an RESP rather than pay off debts with non-deductible interest. Pay off those debts, then catch up on Junior’s RESP.

To summarize what we’ve learned so far:

- A great strategy is to maximize free money (CESG) with regular RESP contributions

- Front-loading an RESP is inferior to CESG-maximizing unless RESP funds are coming from non-registered, taxable accounts. If the funds are coming from a non-registered (i.e. taxable) account, front-loading the RESP may be about as good CESG-maximizing, or a little better.

But is there a way to get the best of both worlds?

Well, yes, there is.

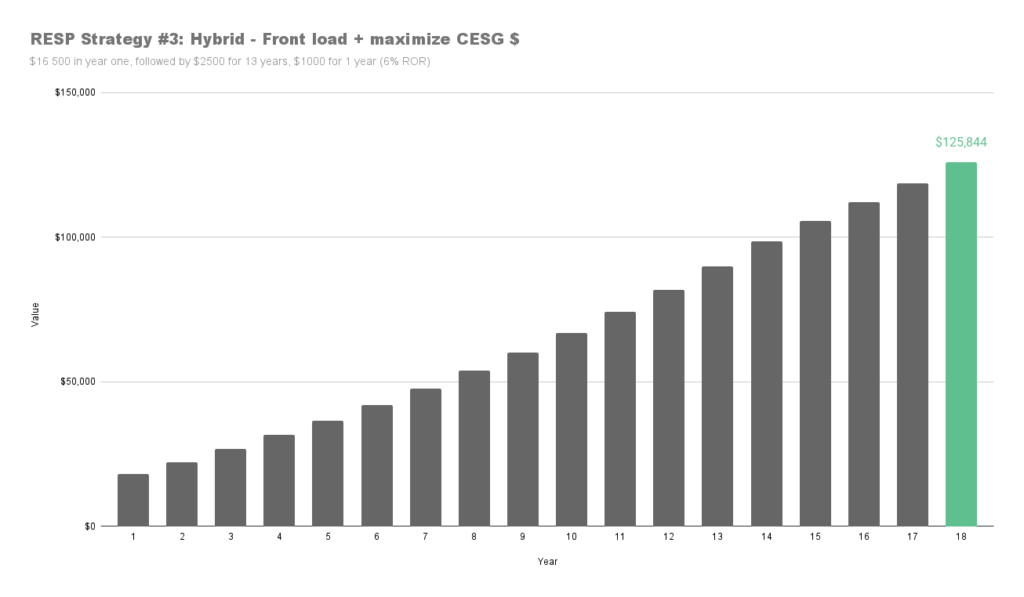

Strategy #3: A hybrid approach

This method keeps things simple while balancing the benefits of front-loading and maximizing the CESG. It contributes a smaller, more manageable $16,500 lump sum to the RESP in year one, then follows that with 13 years of $2500 contributions and the last $1000 in year 14. This maximizes our contribution room at $ 50,000 and also maximizes the CESG at $7200. The results of this approach can be seen here:

In contrast to Strategy #1, the hybrid approach would provide the beneficiary about $24k more with a final balance of $125,844vs. $101,514. It would be most effective if the $ 15,000 initial payment came from existing non-registered investment accounts.

The bottom line

- RESPs are a very effective way to save for post-secondary education because

- they structure our savings for this large expense,

- provide tax-sheltered investment growth, and

- give us access to the CESG top-up

- The most effective RESP strategy for most people is to maximize the CESG

- Money in a non-registered account that will not be needed for other things can be used to front-load the RESP

- The best strategy is likely a hybrid approach, contributing a lump sum in year one – up to about $16,500 in year one, then $2500 per year until the $50,000 maximum is reached.

- RESPs are a very effective way to save for post-secondary education because

I hope these scenarios and their explanations help you understand how to fund your child’s RESPs.

If you found this post informative and/or helpful, please consider donating to help with the cost of running this blog. Don’t forget, half of all donations are given to Doctors Without Borders.

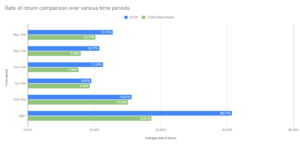

Hi Matt,

Thanks for doing this blog and your website. Not an RESP question, but have you back tested the BTSX method against the 1970’s early ’80s, ie: an inflationary period? I see a couple posts on inflation but no back test numbers.

Thanks,

Harry

Hi Harry, Unfortunately, we don’t have BTSX data going back that far, but given the research I’ve done on dividend stocks in inflationary and rising rate environments, I’m not changing my portfolio.

This is a great post Matt. You have laid out scenarios that we didn’t consider. We invested the maximum each year to get the grant. Then invested the funds in mostly dividend stocks like the rest of our portfolio. In the last two years we added some technology companies. Now we are in the second year of withdrawing for our sons education. This strategy was so successful that he actually has to pay some taxes this year.

Thanks for this article. I have 9 year old twins and have been contributing $5000 to an RESP since they were born. I was planning to maintain this pace until they are 18 to maximize the benefit, your scenario 1. I do have some cash I can contribute in a lump sum, and given where the market is today (Oct 2022) it might be a good opportunity to load extra funds into this account. The RESP is currently down 15%, and my (and wife’s) TFSAs are maxed out. Seems like adding funds now might be a better strategy over the next 9 years than adding annually.

Sounds like a reasonable approach if you are already taking advantage of your other registered accounts and are quite certain you won’t need that money. You can add an additional $15k per child and still continue to contribute $2.5k per child annually for another 4 years – this would maximize the CESG you receive and provide the benefit of tax-sheltering those additional funds.

BTW, I visited your website and your photos are absolutely stunning, Mike!