Success is not the result of knowledge, talent, or even skill. These things help, to be sure, but the most important determinant of achievement is step-by-step improvement. It doesn’t matter how many times you fail, as long as you take those lessons and get back to it. It doesn’t matter if you start clueless and awkward as long as you learn and keep trying.

Aspirations of success are daydreams; a dedication to incremental improvement is life work.

Acknowledging failures without dwelling on them is a trick seldom mastered, but it is just as important in personal finance as it is in the rest of life. Humans are not wired to be good investors. The best we can do is side-step our tendencies to make bad decisions by sticking with an evidence-based plan.

But all plans have soft spots. Those weaknesses are often revealed when the markets go haywire. We can ignore them, make excuses for them, or acknowledge them and try to do better next time.

I am not virtue-signaling. To prove it, here are three things the COVID crash has taught me, in increasing order of face-palm force.

Be more careful about sector concentration

I was over-exposed to the oil and gas sector. I knew I was, but thought I was okay with it. When the double-whammy of COVID-19 and the oil price war decimated these stocks, I found my comfort level to be far lower than I thought it would be. I didn’t want to sell out of the stock market, but I also didn’t want so much of our portfolio to be linked to the energy sector.

Unfortunately, I didn’t see this soft spot in my plan until after stocks like IPL and PPL lost 75% of their value. I didn’t panic, but I didn’t like the options I was facing either. I could hang on and ride it out, but this would just perpetuate my planning error; besides, divided cuts seemed imminent. I could buy more with the cash I had been saving – this would have been pure speculation, and a sure-fire way of inducing insomnia. Or I could pare my positions and correct my over-concentration error buy buying other stocks that diversified our portfolio a little more.

I chose the last option. Since then, the stock that I sold has out-performed the stock that I bought. Some might think that means I made the wrong decision, but at the time no one knew what was going to happen – some of those energy stocks could have (and still could) cut their dividends completely, or drop by another 75%. Even though the short term outcome has not validated my decision, this incremental improvement will allow me to avoid the same mistake in the future, improving our long term performance.

Volatility can turn you into a market junkie

Fidelity did an internal study of their retail investors’ self-directed accounts between 2003 and 2013 to see which ones did best. Which investors came out on top? The dead ones. Second best were those who forgot about their accounts. That’s right, the best performance was achieved by those who did nothing. It’s a dramatic example of an investment fact that is just as true as it is counter-intuitive: doing less is usually the best course of action.

You’ve read it here before: develop a plan, put it in action, then ignore the volatility. But unless you’re blissfully unaware of your exposure to the stock market, it can be very difficult to put in practice.

These are historic times and most of us have been glued to the news. As we keep up to date with current events, we can’t escape the financial drama that is packaged with the rest of it: the fastest market decline in history, negative oil prices, comparisons to the Great Depression . . .

These are threats, and evolution has wired us to be hyper-sensitive to threatening situations. News channels do battle for our attention by capitalizing on this fact with a never-ending barrage of shocking stimuli. Our lizard brains can’t help but respond emotionally to threats and we are driven to neutralize them.

Although I run this blog, I generally spend little time checking my own investments. I know the behavioral errors frequent checking can trigger and I’d rather be building something in my workshop or doing something with my kids anyway.

But recently I’ve turned into a financial news junkie, sucked into the vortex of events, announcements, and predictions. On the one hand it induces a vague sense of understanding and control, but like any addiction, it always leaves me feeling like I need more. I’ve stumbled into the trap laid by the financial-news-entertainment industry and I need to summon Fidelity’s dead investors to get me out.

But it’s hard to ignore the stock market when part of your investment plan hinges on the very volatility you know you should be ignoring. Which brings me to my biggest mistake: I had been waiting for buying opportunities with about a ten percent cash position.

Don’t over-value cash

Having about ten percent of our savings in cash was part of our plan. It made me feel better over the last decade as the bull market went on and on. We would be able to take advantage of the market crash that always felt right around the corner. To be fair, I’m not sure I could have stomached more exposure to the stock market, but the events of the last two months have taught me a few things.

- Holding cash with an intention to buy at lower prices forces you to become a market news junkie. I had to be paying attention to all the volatility – how else could I decide when and what to buy? But the news changed constantly and the market responded in schizophrenic ways, making these decisions surprisingly hard.

- Holding cash made me feel worse, not better. I agonized over when to buy: after a 20% drop? 30%? Maybe I should keep waiting for 50%? Should I use up all of my “dry powder”? Half? Two thirds? I thought the cash would be calming during a downturn, but it had the opposite effect.

- Holding cash had a negative impact on our wealth. Buying when there’s “blood in the streets” sounds great in theory, but ignores one crucial point: What was that cash doing up until that point? We’ve had a ten percent cash position for years. Even though I invested most of this cash at the end of March when the market was close to its lows (lucky), I’m embarrassed by the thought of how much better off we would have been if we had invested that cash years ago. To be specific, one of the stocks I bought was TD at about $54 – a great discount from its recent highs around $76. But I could have bought it in 2013 around $42 and been collecting dividends all this time. Face palm.

Even knowing all this, I struggle to change my habits. I am still tempted to be overweight in financials, but is my confidence in the sector unfounded? I still struggle to break the habit of checking the day to day performance of certain stocks in our portfolio. And I am still reluctant to invest our remaining cash – just in case the market does what we’re all afraid of and takes another nosedive. My lizard brain is tuned into the threats and hacks away at rationality with endless “What ifs . . . ?”

My hope is that by discussing my struggles, you will be more willing to grapple with yours. If you’re feeling brave, tell us in the comments about one of your own soft spots and what you are trying to learn to do better. This is a safe place – I will filter any nasty or judgmental comments. Incremental improvement is better accomplished by learning from each other.

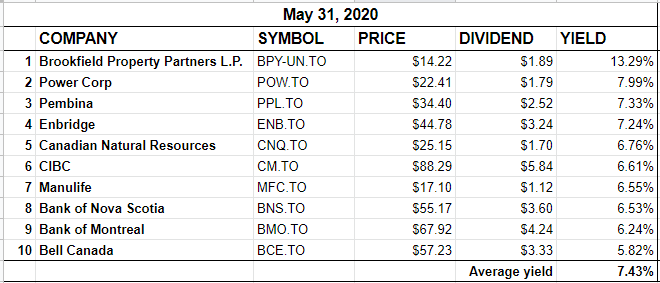

In closing, here is the updated BTSX portfolio for the month.

BTSX June 2020 portfolio

I feel your pain. I’d been waiting for months to invest an inheritance and finally in late January I was able to pull the trigger. Face palm! Since then, I received a bit more and caught some “new lows”.

I’ve been trading in and out of some of the BTSX stocks through May, and now have a 15% cash position. 70% of my positions are still under water from January but much ground has been recovered. Now, when do I sink the cash back in? That is the question!

I suspect I’ll try for some more swing trades but I’ll also be content to leave money invested for the longer term if necessary, after all that’s why I came here in the first place!

I can’t blame you for wanting to “swing trade” to make up for those losses, but the irony is that you were punished for making a sound decision – just getting invested. I sincerely hope the active style you are adopting doesn’t backfire. It’s easy to develop a false sense of confidence in a rising market, even if it’s only been rising for two months.

Hello All,

Firstly, I love this blog and this website and I am a newbie investor who stumbled here only because I thought to myself there has to be a benefit to not just putting my money in an index and buying yield. Lo and behold I found this site, so thank you for that. THANK YOU.

That said, I too am suffering the EXACT same mindset of holding cash, even in the midst of what is still a sale for some assets that still have uncertain futures. I’d argue to your point above, that making bad decisions (freaking out and selling, moving money around too much etc) outweighs cash on hand. And, if holding cash on hand gives you a sense of stability and opportunity and help ‘level you out’ well that’s priceless. And, while money was left on the table and not earning, you potential stopped yourself from bad behaviours… The lesser of evils I suppose is what I am getting at. Anyhow, excellent article as is everything on this site.

I’ll try to be more active on my commenting as this is a great community but I usually just sit on the sidelines when it comes to online forums :/. I can you could call me the cash pile of online forms.

My favourite kind of comment – friendly, with a slightly different spin on the content. Thanks for contributing to the discussion, Dave, and your points re the behavioural benefits of holding cash are well-taken.

I break my portfolio into 3 categories; CASH – STH (Short term holds) – LTH (Long term holds).

1) CASH: My cash is at 20% but I include short term bond and gold bullion in that. I expect a 2nd downturn by fall and will add to my LTH with it.

2) STH: is at 29% and the caveat is that the yield is less than 3%. 12.% of this figure is gold miners. I ride this because of overall government debt. Will liquidate back to only bullion at some point but likely 2 years out. Tech is also included here as the yield is limited. I am overweight 4% YTD as gold and tech have outperformed.

3) LTH: is at 51% with a target of 70%. Infrastructure, Utilities, Telco, Pipelines. Yield must exceed 3%. The only reason I would sell these would be if their story changes dramatically.

4) Watchlist: for those stocks I have always wanted to own at a reasonable price. They would have to hit their 52 week lows for me to buy. Same as my LTH’s.

That is my thinking and process.

Interesting to see other people’s styles, CT. Have you felt the need to adjust your process in the last few months?

I have never carried as much gold in the portfolio as I am now. I am up 38% so no complaints. I think this could be a 18 month to 2 year hold as the full ramifications of government debt is realized. No! No bitcoin.

I am getting more methodical in how I deal with buy/sell. I won’t hang on to stocks which are dropping into my sell territory. My broker now as a Watchlist which is working well with email notices.

Never carried as much gold as now. Government debt the reason why. Trying to be more methodical about decision making to help the buy/sell process. I carry about 15 long term hold stocks which I will add to if the market drops back to March levels. The rest of my short term holds I will sell if need be. You get older and you realize that time might not be your friend in a long recovery.

Hey thanks for posting your honest account of your self-guessing and anguish. I think we all feel like that. My big bonehead move was selling $200K of high dividend ex-Canada ETF’s in February and buying $50K of BPY.UN, $40K of EIT and mostly, thankfully, BMO ZEF emerging markets bond fund.

I would have been way farther ahead to have held on to what I already owned as those funds have pretty much recouped what they lost in the March melt-down. I was chasing yield out of pure greed but I’m retired and my dividend income was already more than I needed to fund my retirement. Sadly, its my form of grasping – most of which I have tried to eliminate from my life. So, my lesson was stick with your plan and don’t be so f*&%king greedy.

Thanks so much for sharing your experience, Marko. I respect people who are able to candidly own the consequences of their actions. The humility muscle needs occasional exercise: my post was an effort to emulate those who are better at it than I am, in hopes of building capacity. Sounds like you are now clear on something that was previously fuzzy – that’s a win.

Don’t beat yourself up Marko. No one knows the future. If there wasn’t a pandemic that wouldn’t have happened and you wouldn’t be here writing about it.

One thing I do (as a learner as you’ll note above I’m a newb or at least feel I am one) I always look at decisions as weights of my portfolio. If 200K is 10% of your portfolio than that is different if it’s 100% or 50% etc. My general understanding of the assets you have listed EIT, BPY, BMO ZEF is that two of those were considered higher risk, with BPY as one of the largest REITS on earth not being as risky. Again, depending on your allocations and overall strategy, not a bad decision, just bad timing.

I think the big question we should all ask ourselves is are we trying to time the market? If so, what makes you think you can do it successfully when so many others fail? If you’re not fully invested, if you’re waiting for another market drop, if you’re rotating between different asset classes, you’re trying to time the market. Keeping a portion of your assets in cash can be a prudent measure sometimes, but it’s still market timing. I admit I can’t time the market successfully and consistently so I’ve stopped trying, and it’s been a great relief. Get invested, stay invested, stop reading the news, stop watching your stocks, enrich your life in other ways.

Totally valid point, Tim. When the market had dropped about 25%, I thought it was going down way more, but I was surprised at my reaction: I just wanted to invest the cash and be done with it. This was the biggest surprise for me – not that I can’t time the market, but that having the ability to time the market (i.e. cash) didn’t give me the peace of mind I thought it would. When I bought in I wasn’t scared that the market would go down further, I just felt relief. I will hold far less cash in the future.

Tim, I have traditionally been a buy and hold investor with building cash flow as my prime concern. Above I mentioned that I have never had as much gold as I do now. Market noise can lead to bad decision making. As I get older I realize the recovery time just isn’t there anymore so I get more conservative. The level of government debt globally has never been higher. World demographics don’t bode well for long term growth. Deflation followed by inflation. The debt cannot be paid so they will monetize it. Thusly the gold.

Your points on sector allocation and holding cash were bang on based on my past experience.

My broad based international high dividend ETF (iShares XDG) didn’t move down all that much and recovered whereas my Canadian ETF’s got hammered and are still down quite a bit – sector allocation dampens the wide swings.

Until last year I use to have $45K in cash but never did anything with it other than collecting the high tax interest in my TD DI cash account.

Sector Concentration: I had 50% of my portfolio in the financial sector through the 2008 to early 2009 financial crisis. After seeing what happened with that sector outside of Canada, I don’t do that anymore.

Volatility: Just over 20 years ago, Lowell Miller referred to it as “bouncing principal”. I do the best I can to ignore volatility. At the end of each year I’ll check my brokerage account to see how much dividend income has been received for that calendar year. That’s about it.

Cash: I held cash waiting for bargains before entering the financial crisis. I used my cash allotment up within a few weeks of 2008. Another thing I don’t do anymore. I hold cash in a bank account to pay for our monthly expenses. Also hold cash as an emergency fund. Not to be used for any other purpose. If I have to dig into the emergency fund, then that becomes the high priority that gets replenished asap. My own preference is when I have investable cash from a combination of savings and dividends, I invest, in any market.

Energy stocks: I still hold pipeline equities. Quite willing to add to any that haven’t cut their dividend or reached my maximum percentage limit for any equity in the portfolio.

Sounds like you’re comfortable and confident in your own plan – good for you.

Thanks for being so honest and giving us a look into your beharvioural brain and sharing. I follow a very similar investing process (I started in 2009 and my portfolio is grounded in BTSX – David was my inspiration and i continue to follow Moneysaver articles religiously regarding the strategy). I do, however, buy other stocks outside BTSX, and have also been in anguish about what and when to buy. Almost all of these non-BTSX stocks in my portfolio are consumer related that I can easily understand. I have learned long ago that if I can’t understand a business that I should stay away (that Lynch guy knew what he was talking about). And who can’t understand a business like SBUX, etc.? Reading your stats on how most portfolios that are left alone do as well, if not better, than active buying and selling during big swings has actually brought me some relief. I only bought one stock in this downturn, and that is BRK.B (I averaged down throughout). Will it pay off? I dunno – but I’ve never owned it, Buffet is my hero, and if he can’t come through this than I don’t know who can. I had a watchlist of other companies, but never pulled the trigger….but all throughout I kept hearing a voice that said “You have a plan, do nothing is Plan A. It’s OK.” Well, I may have not supercharged my portfolio by buying at the perfect -40%, but I do feel more confident doing almost nothing during such a massive downturn, as my plan and asset allocation is sound. Am I overweight in a few areas? Yes, banks are looking to be a drag….but overall I feel like I have now had an opportunity to really test a plan, and that test was all about doing very little.

If I was to identify a soft spot – for those other stocks I buy outside of BTSX and the US Dogs (which I also use), I need to listen to myself more and trust my gut. At the beginning of COVID, my gut told me that more people would watch Netflix, that Amazon would likely crush it, and that grocery stores looked like obvious winners. But, I didn’t buy as I just wasn’t confident to pull the trigger. Who knows what they will be looking like in a year though….again, having a plan that is 70%+ automated with annual re-balancing is the key I think to sleeping at night. Investing, in my opinion, should be founded in simplicity.

Thanks for the comment, but be very careful “trusting your gut”. Rules-based investing has many advantages. If you feel the need to invest based on intuition, I would suggest setting aside some play money – not more than 5-10% of your savings. Write down all your gut-feelings – literally, write them down – then hold yourself accountable by coldly reviewing the accuracy of your predictions. If you are an investing prodigy, that 5-10% will quickly grow; if not, you won’t have lost too much.

I don’t mean to be harsh, but the stock market has a sneaky way of teaching investors the wrong lessons just as often as the right ones.

“Holding cash made me feel worse, not better.” This is such a good comment. I never thought of it that way, but always believed that the holding of cash was useless. For me the best time to buy stocks is when you have cash. (Waiting for the right time is mostly missing out on income.) We have followed this for the last 20 years as we built our dividend income retirement portfolio. My measure of success is the amount of safe dividends our portfolio provides. Now that we are retired and no longer buying more we take the cash out to spend. Our dividends this year are ahead of last year so the value fluctuations in the overall portfolio really don’t matter. Our portfolio is overweight financials (banks), but so what? they are the safest dividend payers out there. We have very little in energy and commodities as these sectors are too unreliable as has once again been proved in this downturn. We will stay with our plan and collect dividends. Great column.

Thanks DivInvestor – I totally agree. My favourite spreadsheet is the one that tallies our annual dividend income. It has a nearly magical ability to get me invested (to increase those dividends) and keep me invested (to maintain the income), and at the same time calm any anxiety over price volatility. Thanks for the comment.

Pingback: One more year — DividendStrategy.ca