There is one name that stands out from all the rest in any discussion of DIY dividend investing in Canada, and that is Tom Connolly. Author of the long-running printed “Connolly Report” (retired last year), creator of the dividendgrowth.ca website (still open to membership at a very reasonable price), and oft-quoted authority by media outlets such as the Globe and Mail and MoneySense, Tom has been educating Canadian investors for over forty years.

The contribution of this website pales in comparison to his sustained efforts and accumulated wisdom. But serendipity has prevailed and, fortunately for us all, this blog has served as a catalyst to connect us with Tom (thank you, David Stanley for the introduction).

On behalf of all the readers of this blog, I would like to thank Tom for taking the time to answer my questions about dividend investing and the challenges facing DIY investors today.

You’ve been educating DIY investors for almost 40 years – long before blogs and the Internet. Why did you start the Connolly Report in 1981?

The Connolly Report, since 1981, grew out of my teaching. I taught economics, finance and accounting in the 1960s and 1970s. I was looking for a better way to invest after the last big, terrible, bear market in the 1970s. I encountered dividend growth quite by chance in a letter to the editor of the Financial Times.

Are the challenges that investors face now very different from then?

Over the years investing does not change much. It is, after all, a human game. When I began it was the Nifty Fifty, now it’s the FANGS. There is too much information today and most of it is slanted and wrong. For a portfolio, for instance, folks are lead to believe that more securities is better (scores in a fund), when it is really fewer, but quality individual companies that outperform.

Have there been any major changes in your approach in this time?

My research at Queen’s into the methods of the ‘old masters’ Keynes, Graham, Burr Williams and Bernhard who founded Value Line, for instance, has allowed me to polish the dividend growth strategy. Most investors do not realize that as the dividend goes, so does the price.

What are the common mistakes you see DIY investors making?

The most dangerous problem is in the investor himself/herself: lack of discipline and patience. Other mistakes include opting for high yield when return = yield plus growth, thinking bonds are safer, falling for modern portfolio theory, getting sucked into storied stocks, believing volatility is risk, thinking professionals can do better and trivializing the importance of dividends.

Obviously, you are a dividend investor, but you focus on dividend growth investing rather than yield or value. Can you explain your approach?

The essence of dividend investing is to seek sustainable cash flow from a company because increasing cash flow (growing dividends, if you like) makes a security more valuable and drives price growth. Initial yield is very important (not too high) as is growing yield (the dividend growth rate) and buying at a “sensible price” as Charlie Munger says. I use three valuation measures: yield, Graham’s formula from his Intelligent Investor and CAPE (cyclical p/e).

More and more investors are moving toward index investing. What do you think about this approach?

Indexing investing when the market is high is the height of folly. Regardless, indexes are loaded with mediocre stocks: a few individual, quality issues win.

What are your thoughts regarding how investors should ideally draw an income from their investments: dividends vs. capital gains vs. a mix of the two?

Set up your retirement portfolio (really a long-duration trust) of a few quality dividend growth stocks well before retirement so that when you are retired most of your needs are supplied the growing dividend income. Know that as the dividend grows so does the price. Now, because your capital grows too, you can supplement dividend income with capital withdrawals without touching your original stash. After over twenty years of retirement, our original capital is still more than double what we started with. One portfolio is more than triple the original $200,000 and generates close to $40,000 in dividends.

Many dividend investors find it difficult to diversify across sectors given the concentration of the Canadian economy in relatively few areas (financials, telecoms, utilities). How would you suggest approaching this challenge?

Sectors are not a challenge. You do not need all sectors. I diversify my portfolio across four or five sectors. Seek the sectors that generate steady dividend growth. CNR in industrials, for instance, food retail in consumer durables and even CCL.B in materials besides telecoms and electrical utilities, good pipeline and a bank or two.

You’ve been investing for a long time. What are your thoughts regarding asset allocation (the proportion of stocks, bonds and cash in one’s portfolio) in various stages of one’s investing life?

Once you realize that increasing cash flow from quality, individual companies makes a stock much more valuable than a bond, it is all stocks for superior returns. I have never owned a bond. Never will. Bonds do not stop stock prices from falling. It’s in the math. Once a person has seen what dividend growth stocks do after being held for years, they usually decrease their bond holdings. Always a good portion of cash, though: emergencies and opportunities.

Over time dividend investing seems to drift in and out of favour. What do you think the next few decades has in store for dividend investors?

Fads come and go but good companies keep on growing and paying income. When markets are exuberant, dividend stocks wane: when there is fear, they shine.

Your readers’ big problem will be in not believing what I dug out during some 40 years or research. The facts are there if they are open to considering it. As Ben Graham said in his 1963 speech, one has to invest differently to win.

Thanks so much to Tom for taking the time to answer my questions. If you’re interested in learning more, his blog, dividendgrowth.ca, is packed full of insights and information.

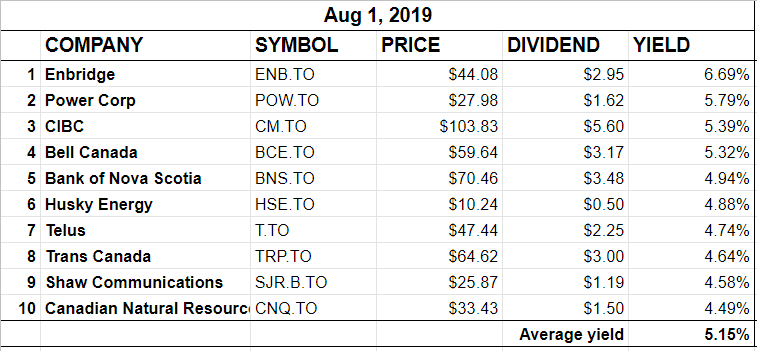

In the meantime, here is our BTSX list this month. (Interestingly, HSE and CNQ are on the list, Husky Energy jumping all the way up to 6th spot! This is due to a recent decline in stock price, not a dividend hike. In fact, HSE’s dividend history is far from consistent. I can’t predict the future, but I have to be honest: I’m not comfortable owning HSE for that reason.)

Thank you – a lot of good dividend investment reasoning and food for thought. I agree with Matt re Husky Energy – the technicals don’t seem to display much confidence.

Thanks for that excellent interview. I agree with everything Tom stated – such as “Indexing investing when the market is high is the height of folly.”

Great that you had Tom Connolly on . I am a member of his site and love his monthly insights. His approach is spot on, and yours as well. 🙂

Great interview. I have followed Tom for a long time. In my opinion, he is the guru of dividend investing.

Pingback: Investor Spotlight: My Mum - Our Life Financial

Pingback: Should you invest for dividend yield or dividend growth? —