I heard a story from a real estate friend of mine recently that is worth sharing. Over the coming weeks and months, I wouldn’t be surprised if many more of these stories emerge.

This is a story about a young couple who were trying to buy their first home. They’d been watching the market closely for over a year, checking Realtor.ca every day for new listings, and had saved as much as possible for a downpayment. Even as my friend helped them with their search and their downpayment grew, however, they fell further and further behind because prices kept rising even faster. What used to be the top end of their budget became the bottom end, then just a fantasy of affordability. If they didn’t buy something soon, they feared they’d be priced out of the market permanently.

When their dream home came up for sale, they vowed that this time they would not miss out and jumped in with an unconditional offer over asking – and it was accepted! Finally, their dream was coming true – even if it was a stretch, financially. They’d done their research, saved diligently for the downpayment, and had even been pre-approved for a mortgage that would cover the balance . . . if just barely.

As the closing date approached, their mortgage agent arranged the requisite home appraisal that is required by every mortgage lender. The couple didn’t think much of it until their agent called them a few days later.

“Well, I’ve got some tough news. The appraisal came back quite a bit lower than what you paid for the house.”

“Oh, is that a problem? We were already pre-approved, and we have the downpayment money, so we’re good, right?”

“Well, not really. That pre-approval is conditional upon the appraisal. The bank has to protect itself. They’ll still give you a mortgage but for a lower amount.”

“What? We’re stretched to our limit already! How much lower?”

“Uh, well, $175,000 lower. You have to come up with $175, 000 by the closing date next month.”

Boom.

This is a true story.

Home buying hysteria

Canadians have been on a housing bender for years. Perhaps our resilience during the financial crisis of 2008/09 bolstered our confidence. Despite the fact that perma-real-estate bears like Garth Turner kept sounding the alarm, prices marched higher. In 2015 a report published in The Economist called Canada the most overvalued real estate market in the world based on rental rates, and the third most overvalued based on income. Yeah, that was seven years ago. Look what’s happened since then.

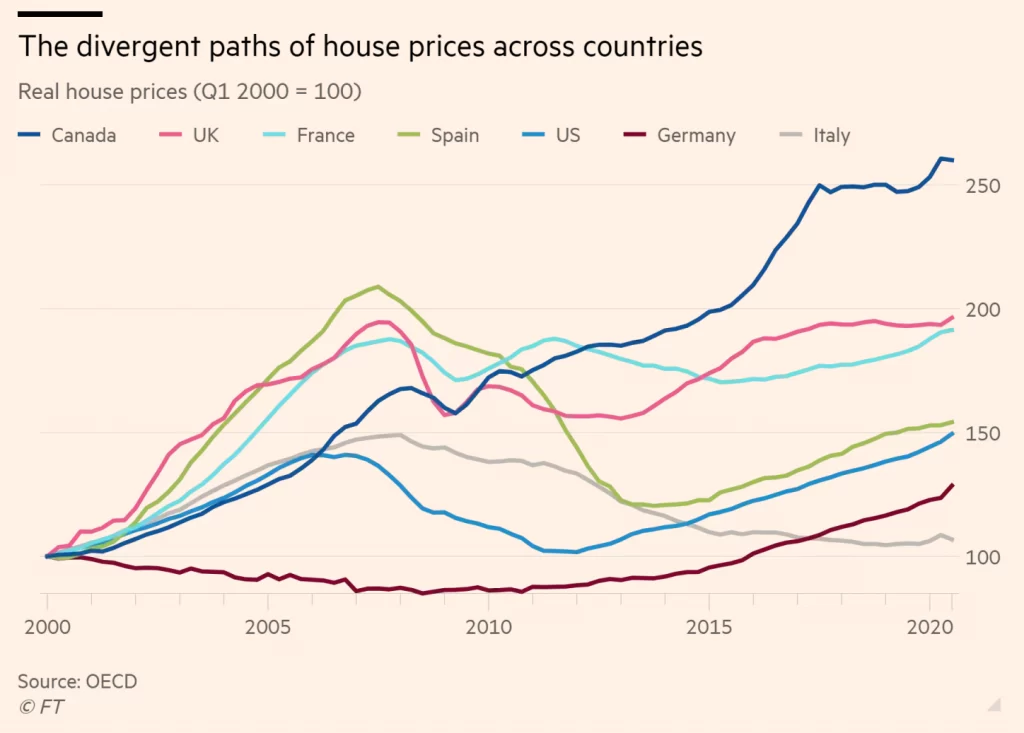

Canada’s housing market didn’t crash, it didn’t ease into a plateau. Nope, it found another gear and rocketed higher. For twenty-two years, real estate hasn’t just marched upward, it’s defied gravity. I think we can all sympathize with first-time home buyers; the best time to buy always seemed to be last year. Year after year, prudence was punished. When you’re living it, it can be hard to appreciate how anomalous the climb has been, but a comparison to other developed countries is illuminating.

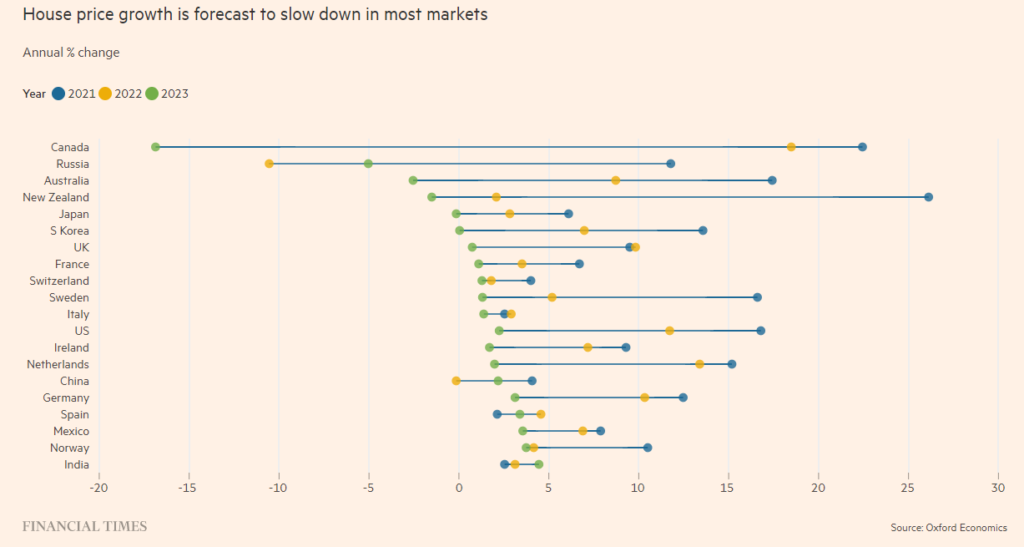

What is in store for the Canadian real estate market? I have no idea. I’ve been wrong so many times that I’ve given up trying to predict these things. But given how out of whack house values in Canada seem to be compared to other countries, the Financial Times has taken a stab at it. Here’s a chart you don’t want to be at the top of:

Whether or not housing prices in Canada are going to go down 17% in the next year or not, as the chart above suggests, is anyone’s guess. There certainly seems to be a lot of articles about buyer’s remorse these days, and prices seem to be deflating, but maybe we’ll see a bounce. Or maybe they’ll crash by 30%. I have no idea.

What I do know is that a lot of people seem to have lost their heads in this housing bubble we may or may not still be in. Research and reason are too frequently tossed aside in our desperate attempts to “get in before it’s too late”. No matter where things go from here, I hope that sharing my thoughts on home buying are useful for you or someone you know who is in the market.

How much house can you afford?

Personal finance is full of rules of thumb, and housing affordability is no exception. Just like any other rule of thumb, use it to see if you’re in the ballpark then, if you are, drill down into a more detailed analysis. A rule of thumb doesn’t replace due diligence; it just helps you know when to do it.

Here are a few rules of thumb that may or may not be useful:

The 28% Rule: No more than 28% of your gross income should be allocated to your mortgage payment

The 32% Rule: No more than 32% of your gross income should be allocated to your mortgage payment, home insurance, mortgage insurance, and property taxes combined

The 40% Rule: No more than 40% of your gross income should be allocated to your debt payments in total (mortgage, student loan, line of credit payments, etc.)

When you should lower your house budget

When you’re high on the fantasy drug of home ownership it’s easy to think of reasons to spend more. But let’s give our inner skeptics a little game time and remember a few legitimate reasons to spend less.

Are your long-term savings (FI/retirement) in good shape? No? Lower your budget.

How many earning years do you have ahead of you? Fewer earning years? – lower budget.

How comfortable are you carrying debt? If debt stresses you out, lower your budget.

What else is important to you that might be impacted by high housing costs? – travel, family, hobbies . . .? When you fall in love with a house it can seem like nothing else matters, but believe me, a bigger house won’t make you happy. Look objectively at your other priorities and how the ball and chain of high mortgage payments might affect them. You might want to lower your budget.

Pre-approval ≠ affordable

Don’t be fooled into thinking that the mortgage you are approved for is what you can afford. It is simply what the bank will lend you to maximize its profits while minimizing the risk of default. They don’t care if you’re house-poor or have to work until you’re 75 to pay it off – but you probably do.

Just for fun, I plugged exactly the same income ($300,000) and down-payment ($300,000) numbers into all six of the big banks’ Mortgage Affordability Calculators. The variability of results shows how ridiculously unreliable the lenders are at determining how much home buyers can afford. Here are the results:

- RBC: $1,216,947

- BMO: $1,500,000

- Scotiabank: $1,663,588

- CIBC: $1,200,000

- TD: $1,050,000

- National: $1,500,000

A $513,000 difference between the highest and lowest doesn’t exactly inspire confidence. My skepticism deepened when I plugged exactly the same numbers into CMHC’s affordability calculator and got the following result: “You may be able to afford a home priced up to $847,040”. That’s about half as much as some of the banks would have you believe. No wonder so many people are over-spending on houses.

FOMO buying

Don’t be pressured into buying a house just because prices seem to be going up relentlessly and you’re afraid of missing out. In my opinion, there is never a good reason to buy more than you can afford. Wait, lower your standards or rent. Don’t forget: prices can go down – there are many examples around the world – just look at the charts above. That is exactly what seems to be happening now in Canada with prices down 15 – 20% in many areas. I can’t predict how this will pan out, but I am reading a lot of headlines these days about home buyer’s remorse (here, here, and here, for example).

Don’t count on a great rate of return

A common justification for spending more than you can afford is the refrain that “real estate is a good investment”. Be cautious here. Even if house prices don’t decline much more, historically, real estate has significantly underperformed a simple investment portfolio – and those numbers generally don’t take into account the extra real estate costs of commissions, property tax, utilities, maintenance, etc., making real estate rates of return even worse than they appear. This chart only goes up to 2020, but you can see that real estate has underperformed:

On a related note, I caution against viewing your primary residence as an investment, i.e. “We can spend more on this house because real estate has been a great investment, right?” Real estate can certainly be profitable when leverage and sweat equity is involved, but let’s not conflate income-producing investment properties with homes.

Do’s and don’ts of house budgeting

A lot of people go about budgeting for a house backwards. First, they figure out the house they want, then they try to make everything else work around that.

Instead, I would suggest making your long-term financial plan first.

Step 1: Make sure you know exactly where you’re starting from: income, spending, debts, savings, etc.

Step 2: Set the big goals – When do you want to be financially independent and what will that lifestyle cost?

Step 3: Figure out what you need to save/invest to accomplish those goals.

Step 4: Figure out your lifestyle costs now and for the next 5 – 10 years: kids, food, clothing, work-related expenses, activities, vacations, hobbies, etc. etc. etc.

Step 5: Make sure you know your after-tax income and subtract what you need for your lifestyle and long-term savings on an annual basis. As long as you have no other debts, the rest should be what you have available for housing costs.

But it’s not just mortgage payments. Don’t forget about furnishings, insurance, property taxes, maintenance (~1 – 2 % of the cost of the home annually is a good estimate), etc.

Sidenote: regarding mortgage payments, my suggestion is to make sure you can afford mortgage payments with interest rates 5% higher than what they are now. Safety first.

A final word of caution from a 300 year old French guy

The silver lining to all of this is that, barring high interest rates, if house prices come back down to earth, buying a home will be achievable for more people. But my inner skeptic has one last thing to say: If you’re considering a home in an upscale neighbourhood, beware the Diderot Effect. From Wikipedia:

The Diderot effect is a social phenomenon related to consumer goods. It is based on two ideas. The first idea is that goods purchased by consumers will align with their sense of identity, and, as a result, will complement one another. The second idea states that the introduction of a new possession that deviates from the consumer’s current complementary goods can result in a process of spiraling consumption. . . named after the French philosopher Denis Diderot (1713–1784), who first described the effect . . .

It’s a bigger influence than most people realize – especially with houses.

Thank you so much to those of you who have chosen to support me and this blog with your donations. The fact is that as the blog grows, it gets more expensive to run. I want you to know that your generosity and the thoughtful notes that are often attached to them have a huge impact on the quality of this site.

If you are so inclined, no matter the amount, you can support this site by clicking here:

Selfishly, as long as what I can get for my home today, will buy the same thing as what I will get for my home in about five years when we intend to relocate / downsize then I’ll be satisfied. My only fear with a market “rebalance”, or whatever one wants to call it, is that my housing dollar will become less valuable when it’s time to make our move.

But, then I think about my two children in their early 20’s who will eventually need a place of their own (in, say, about five years – lol) and I also know that they drastically require more affordability in order to succeed in that endeavour.

Time will tell. I try not to over think it. When the time comes we will create a “buy or build” budget that is within our means and how close that gets us to our “dream home” will, well; ultimately be the arbiter of our dream home…..lol