If there is one thing every investor should know about before considering the purchase of an actively managed mutual fund, it is this: the SPIVA report.

SPIVA stands for “S&P Indices Versus Active” and it describes a semi-annual scorecard comparing the performance of actively managed funds to that of their benchmark indices. It seeks to answer one simple question nearly every investor faces at one point or another: Can active managers beat the index?

SPIVA Methodology

The SPIVA methodology is statistically sound and accounts for multiple confounders (from Bogleheads):

- Survivorship bias correction: SPIVA removes funds that were liquidated or merged during a period of study (one year, three year, and five year periods).

- Apples-to-apples comparison: Fund returns are compared to a benchmark for each particular fund’s style and size category.

- Asset-weighted returns: SPIVA reports show both equal- and asset-weighted averages.

- Style consistency: As active funds often exhibit style drift, each SPIVA report measures style consistency for each style category across different time horizons.

- Data Cleaning: SPIVA avoids double counting of multiple share classes in all count based calculations where only the share class with bigger assets is used. Index funds, leveraged and inverse funds, and other index-linked products are excluded since SPIVA is meant to be a scorecard for active managers.

A failing grade for active management in Canada

The most recent report was just published and, once again, the vast majority of actively managed funds in Canada failed to outperform the S&P/TSX Composite over 1-year, 3-year, 5-year, and 10-year time periods. In fact, as the report states:

The 10-year performance results demonstrate the difficulty that active managers had in beating their respective benchmarks over the long term. Over 88% of Canadian Equity managers under-performed the S&P/TSX Composite over the 10-year period ending in June 2019.

SPIVA Canada Mid-year Scorecard

Perhaps you’re wondering if active management fared better in the shorter term. Over the one year time horizon, over 85% of active managers still failed to beat the index.

Interestingly, the scorecard makes specific note of dividend and income equity fund managers:

Dividend & Income Equity fund managers did particularly poorly, with underperformance rising from 65% to 88% as of June 30,2019.

SPIVA Canada Mid-year Scorecard

If you are investing for dividends, it would be wise to review our BTSX results before entrusting your money to a mutual fund manager.

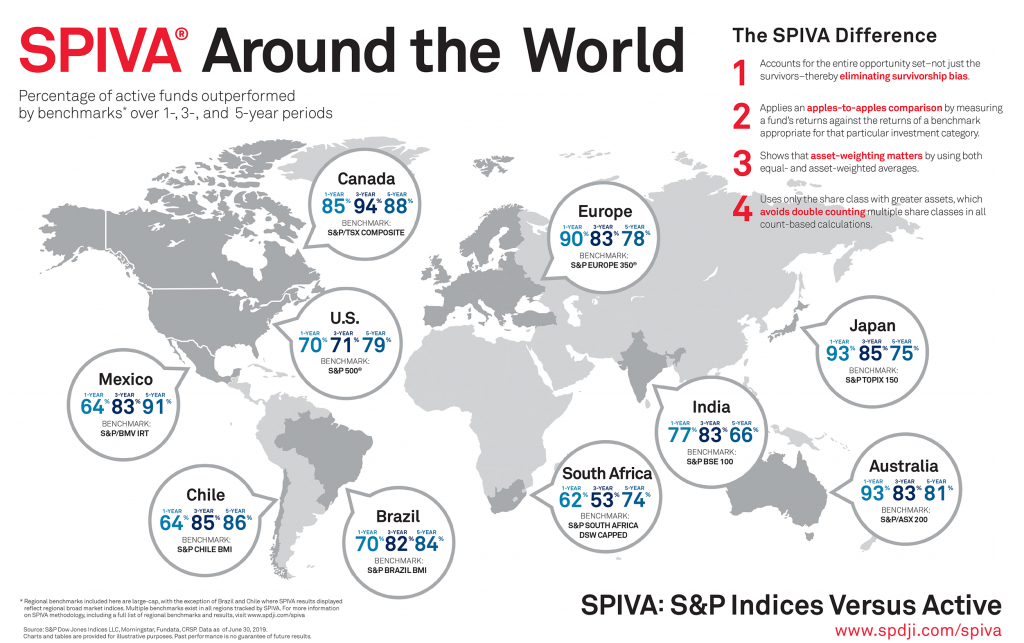

What about international markets?

If you think that the under-performance of active management is limited to developed markets and that emerging markets are ripe with opportunity, think again. Over 1, 3, 5, and 10-year periods, active managers have been unable to beat their indices around the world.

SPIVA started in the US, but now publishes scorecards for numerous international markets. The results are as staggering as they are important: active management doesn’t seem to work anywhere.

As you can see, there is not a single market or time frame in which the average active manager was able to out-perform his/her index net of fees. This begs the question: are these managers beating their benchmarks before fees? Given the time, information, and resources these teams have at their fingertips, perhaps it wouldn’t be surprising, but the Managing Director of Research at SPIVA states:

Our research shows that most actively managed equity funds trail their benchmarks even when gross-of-fees returns are used.

Aye Soe, Managing DirectorResearch & Design, S&P Dow Jones Indices

Even so, it is important to understand that high fees (like those typically found in Canada) make it even harder for active managers to beat their benchmarks.

The bottom line

Chances are, if you’re reading this blog, you’re already well aware that actively managed mutual funds are usually a poor choice for most investors. But we all know people who could use some convincing, so feel free to send them a link to the SPIVA scorecard or this blog. In my mind, this is irrefutable evidence that active management is not the path to wealth.

Where does that leave Beating the TSX? Some might even say BTSX is active itself because it involves purchasing individual equities. I disagree for two reasons: first, BTSX does not attempt to time the market; and, second, BTSX stocks are selected based on pre-determined criteria, not human judgement of future performance. In fact, BTSX follows a methodology akin to the S&P selecting stocks to include in it’s indices.

It is striking that BTSX has outperformed it’s benchmark over the past 3, 5, 10, 20, and 30 year time periods when no other dividend & income equity fund was able to do so (“[F]or the Dividend & Income Equity fund category, . . . no manager was able to outperform the benchmark over the 10-year period.” SPIVA Canada Mid-year Scorecard). The same amount of money invested thirty years ago using the BTSX strategy would be worth more than twice as much today than if it was invested in the index. Long term performance data is what makes BTSX so compelling for many of us.

Building a portfolio of big, mature, dividend-paying equities is neither exciting nor glamorous, but if you can see the strategy through the ups and downs of the market and avoid the seduction of active management, it might be the most effective path to financial independence.

BTSX Update

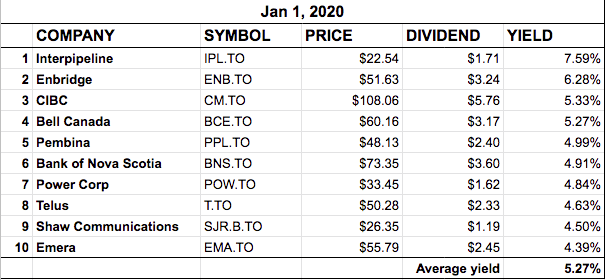

To kick off the new year, we are officially halting the practice of excluding previous income trusts from the BTSX list. IPL and PPL are now included, moving TRP and BMO into 11th and 12th spots and increasing the average dividend yield. Further boosting the yield is ENB who announced a 10% increase in their quarterly payments, which is in line with guidance by the company. Here is the list which will appear in the February edition of The Canadian Moneysaver.

All the best in 2020.

You should include PPL’s dividend increase starting in February in the table

Please send me a link to the announcement. The last two years Pembina has raised the dividend for the May payment and I can’t find anything on their site about a pending increase. Maybe I’m looking in the wrong place?

Are there any studies which show how the BSTX fares in relation to the Bank Index Funds or Vanguard Index Funds or to Dimensional Fund Advisors or other publicly known companies who don’t sell mutual funds but who are financial advisors who manage assets for a percentage of assets managed. I think that that type of information would be very valuable for those investors who know that actively managed mutual funds consistently underperform.

I’m not aware of any such studies, but I’ve never felt compelled to compare BTSX to anything other than the benchmark TSX60 index. For at least ten years we have used XIU (the iShares TSX60 ETF) to represent the benchmark index since its performance data is readily available and reliable. If anyone is interested in comparing performance to another entity, the relevant data is free for the taking on this site (although I still have to create a page with the annual data for the past 31 years). I’d be more than happy to consider a guest post if you’re interested in doing the research and writing a piece!

I’m diversifying a bit into BTSX this year, while staying mostly in a home-brew VGRO/VBAL portfolio with a bit of MAW105 to round things out. Very appreciative of your articles in Canadian MoneySaver and especially of this website. Thanks for what you do.

You’re welcome, Bjorn. Sounds like you have taken control of your own investments and are finding the strategy that you’re comfortable with – perfect.

Power Corp (POW-T) recently announced a major restructuring & that PWF will will be dissolved and fall 100 % under POW. This is to happen in the next 4-5 months or so. On the announcement, POW stock rose about 10%. Furthermore, POW announced that it’s dividend will be increased by 10% ( I believe effective Q2 / 2020). That’s a great bonus for shareholders because over about the last 10 yrs, Power stock has been dead money except for it’s dividend. FYI, I’ve owned PWF since around yr 2000 and was happy till about 8-9 yrs ago so I slowly divested, selling on price peaks. However, due to BTSX, have bought back into POW in mid 2019, and delighted since.

Absolutely right, Edward. For those interested in the details, go HERE.

Pingback: How did BTSX perform in 2019? —

Pingback: Method vs. Madness: the benefits of rules-based investing —

Pingback: The alpha and beta of dividend investing —

Pingback: The real problem with financial advisors —

Pingback: Mutual funds are a tax on uninformed investors — DividendStrategy.ca

Pingback: Mutual funds are a tax on uninformed investors – moneySmartMD

Pingback: The real problem with financial advisors – moneySmartMD

Pingback: I went undercover: the truth about “free” financial seminars — DividendStrategy.ca

Pingback: Is dividend investing evidence-based? 5 key findings – DividendStrategy.ca