For decades, professionals have constructed “balanced” portfolios using the 60/40 stock/bond ratio as a template. Other variations pushed a bond allocation equal to the investor’s age, or other such rules of thumb. These high-bond allocations performed reasonably well in the 1980’s and 90’s, but the low yield world we’re in now has made many investors question the relevance of these approaches. Many investors are wondering: Do bonds belong in my portfolio? Are there any good alternatives for Canadian investors?

What are bonds?

In simple terms, bonds are essentially I.O.U.’s between companies or governments and investors. The bond contract will state the “maturity date” – when the loan is to be paid back; the “face value” of the bond – the amount that will be paid back at maturity; and the “coupon rate” – the interest that will be to the lender during the life of the contract.

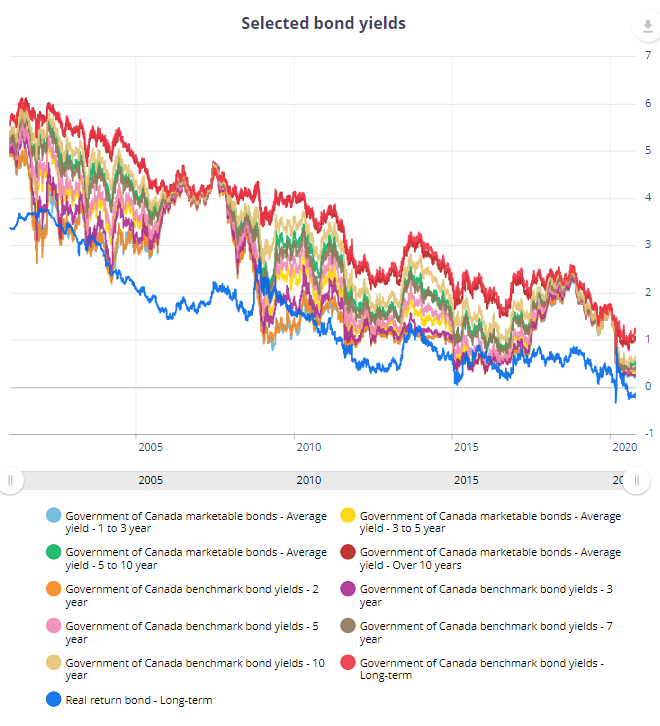

For example, you might consider buying Government of Canada 10-year bonds. The initial price is usually set at “par”, often $1000. This is also the face value – the amount that will be repaid on maturity, ten years in this case. The coupon rate for Government of Canada ten year bonds is currently at a record low: 0.59%. This means that every year the investor is entitled to interest payments of 0.59% x $1000 = $5.90. Hence the term “fixed income”.

The coupon, or interest, that a bond pays is determined by two factors: the credit-worthiness of the borrower and time to maturity. But it is important to understand that there is a market for bonds – those IOUs can be bought and sold. If interest rates go up, a bond yielding only 0.59% won’t be so desirable to other investors and it’s market value will go down. When interest rates go down, prices go up. Thus, price and yield are inversely related for bonds. This is very important to understand if you hold bonds as investments.

The role of bonds in retirement planning

Now that you know what bonds are and how their yield and price are related, let’s go over the three important functions they can perform in investment portfolios:

- Diversification – Bond returns are not correlated strongly with those of stocks, providing a measure of safety.

- Lower short term volatility – We all know how wild the stock market ride can be. Bond prices move more slowly. This can allow the investor to use bond assets for living expenses or rebalancing, rather than risk selling stocks at a loss.

- Income – Bonds produce income in the form of interest. Historically, rates were high enough that this income could contribute significantly toward one’s living expenses. Not so much in 2020.

Bonds have been a pillar of investment portfolios for a very long time, but with yields at historic lows, it seems likely that the real return (after inflation) of bonds will be negligible going forward, probably even negative. Combine this with the fact that interest income from bonds is fully taxable, as opposed to dividends and capital gains which are taxed at far lower rates, it’s no wonder investors are looking for alternatives.

Alternatives to bonds

1. The all-stock portfolio

For many investors, the 60/40 (or 50/50 or 40/60, etc.) balanced portfolio is dead. Some investors are attempting to diversify with other kinds of equities, and they learn to cope with the short term volatility of an all stock portfolio because bond yields are just too low (i.e. bond prices are too high).

In fact, as Jeremy Seigel pointed out in his book “Stocks for the Long Run”, over the very long term, returns of bonds have been more volatile than those of stocks. That doesn’t help us with short term fluctuations, but the durable long term returns of stocks can help investors keep their heads in trying times. Some investors ditch bonds and just buy more stocks.

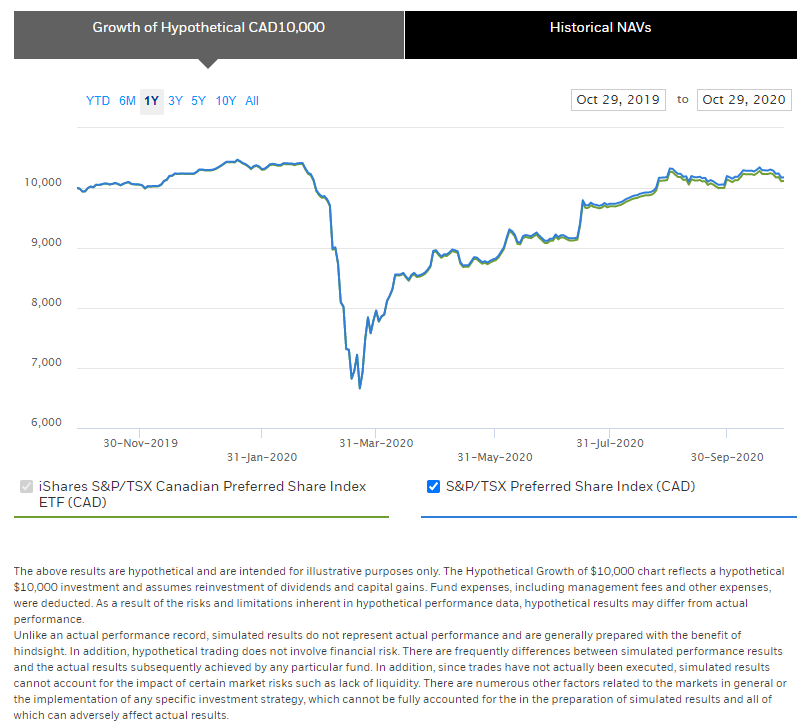

2. Preferred stocks

Other investors have turned to preferred stocks. I think of preferred stocks like a corporate bond/stock hybrid. In simple terms, in exchange for voting rights, which preferred stock holders don’t have, preferred shareholders have priority over company profits. This takes the form of regular dividend payouts at a specified rate for a specified duration. Like a bond, the price of preferred stocks tends to hinge on these payouts and the credit-worthiness of the company; unlike bonds, the yields tend to be higher (about 5% for big blue chip companies) and the payouts are dividends rather than interest.

Unfortunately, overall returns of preferred shares, while higher than bonds, tend to be lower than that of common stocks. Furthermore, short term volatility is still a problem, as this chart of the S&P TSX Preferred Share Index shows:

3. Blue chip dividend paying companies

A few weeks ago I was listening to an interview with Burton Malkiel, author of the classic “A Random Walk Down Wall Street” – one of my favourite investing books – and professor of economics at Princeton. When asked the same question we are trying to answer: Do bonds belong in our portfolios? – I was surprised by his answer.

My own view has changed . . . I think that the role of bonds in the portfolio is something that needs to be reconsidered . . . For the safer more stable part of the portfolio one might consider a bond substitute . . . One type of bond substitute might be blue chip companies that have very good dividend yields.

Burton Malkiel on Animal Spirits podcast Oct 2, 2020

Some investors are still going to want bonds in their portfolios, but in another interview, Malkiel told Marketwatch:

Basically, safe bonds now do not provide income and in the long run may have some real risk, because if we do get some inflation in the future, yields will rise and their prices will go down.

https://www.marketwatch.com/story/investing-legend-burton-malkiel-on-day-trading-millennials-the-end-of-the-6040-portfolio-and-more-2020-06-22

I respect Mr. Malkiel’s opinion on such topics, but this is neither confirmation bias nor an appeal to authority. He has simply stated that bonds no longer do what they used to do – i.e. provide safe income.

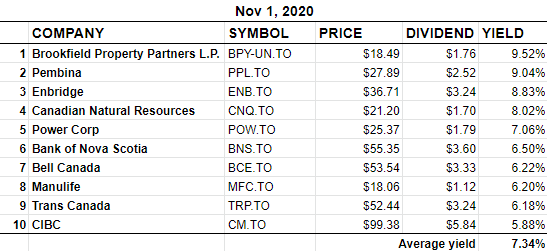

Big, established dividend paying companies with solid cash flow, high yields, and a history of steady dividend increases are not hard to identify in Canada. Our Beating the TSX list is a great place to start. Companies like BNS, ENB, and BCE, which are all currently on the list, have yields over 6% and have been increasing dividends for at least 25 years.

Other companies may have lower yields but other attractive characteristics like particularly strong dividend growth histories or low beta (low volatility relative to the market). You can find a complete list of TSX60 stocks ranked by dividend yield here.

Conclusion

Do bonds belong in our portfolios? Investors still need safety and income from their investments, but bonds no longer fill that role the way they used to; bond prices are too high to be safe and yields are too low to provide income.

Perhaps one of the best alternatives for investors in 2020 is blue chip dividend paying stocks. If your investment plan is already based on buying established companies paying generous growing dividends, I think you can feel confident that you’re on the right track. For those who are not confident with this approach, have a look at preferred stocks. At the very least, it’s time to think about decreasing your bond allocation.

BTSX portfolio update for November 2020

No big changes this month. Not bad news with an average yield over 7%.

I am carrying very little bond exposure in my portfolio and have not for a few years now. Blue chip dividend companies are my choice. That said in my tax deferred accounts like RRSP’s I still carry GIC’s.

When one discusses government bonds I think the question might be how safe they are. On the one hand we cannot condemn government for the ponzi style funding of taxpayer debt and on the otherhand rush to buy this debt. Low to negative interest rates and who will buy government bonds? With the stroke of a pen the government can convert fixed redemption dates to a date they prefer.

If one invests for capital appreciation, then very likely they will want to hold bonds, or other fixed assets to cushion stock market fluctuations. But, as an Income investor, I’ve never considered any fixed asset products as a viable part of my portfolio. The goal of an income investor is to have ones investments generate income and have ones income grow sufficiently, so that in retirement, one does not need to sell shares or be concerned about market corrections. For those who start investing for income later in life they may not achieve the goal of being able to live off the income, therefore they may wish to consider holding some fixed assets or maintain sufficient liquid assets, so that their investment portfolio can continue to grow their income as long as possible.

I usually find that if the majority of investors go one way, I’m usually but not always, better off going in the opposite direction. The one time I didn’t use my contrarian instincts, during the tech craze of the late 90’s, I paid the price.

When I first actually started investing the mantra was to buy precious metals and collectibles. From what I read from the Canadian financial columnists of the time was not to purchase fixed income since interest rates were going to climb over 20% over the next little while.

So with that sound advice what did I purchase for my very first investment? I bought a one year GIC paying 18%. My only regret is I didn’t buy a thirty year Canada or provincial bond paying the same interest rate. Shortly after the precious metals and collectibles markets started to collapse.

Back to the present and you don’t have to look too very far around the globe to see that the world’s third largest economy, Japan, has had to live with extremely low inflation rates ever since their stock market collapse thirty years ago. Reading the real returns for Japan in the 2020 Credit Suisse Global Investment Yearbook we find that from 2000 to 2019 Japanese bonds returned 3.7% while equities returned 1.5%. Go back to 1970 during a long term equity bull market to the end of 2019 and the returns aren’t much better, bonds 3.8%, equities 3.6%. Needless to say, I never underestimate fixed income.

In our own portfolios, the registered accounts are mostly in a low cost balanced ETF at 60% global equity, 40% bonds. With all the turbulence in the markets, It’s been a smooth ride for us this year, and no plans to change the allocation.

Our taxable portfolio, which is almost as big as our combined registered accounts is 100% individual all-Canadian dividend equities. Sticking with this portfolio as well.