Welcome to the long-awaited Beating the TSX annual update!

North American investors have been shaking their heads and shrugging their shoulders at the stock markets during this pandemic – usually accompanied by a cautious smile. Gut-wrenching drops in 2020 were followed by the fastest gains ever. Sitting on the edge of our seats, we waited for the other shoe to drop only to witness a gravity-defying bull market that just wouldn’t quit, even as we sputtered through wave after wave of COVID-19.

As a do-it-yourself investor, it’s all just a reminder that I’ll never be able to make reliable short-term predictions about stocks. But that’s okay because it’s the long term that matters. The greatest advantage individual investors have over the industry pros is that we can ignore the short-term noise and adopt a solid long-term investment plan.

Beating the TSX method

That’s what Beating the TSX is – a long-term plan. Created by David Stanley in the 1990s, BTSX is a simple method that anyone can use to identify Canadian blue-chip dividend-paying stocks that might be worthy for your portfolio. Here is the method:

- List the stocks on the TSX60 by dividend yield.

- Select the top 10 yielding stocks

- Purchase those stocks in equal dollar amounts and hold for a year

The method usually results in a portfolio of stocks with several appealing characteristics:

- They are large (and usually stable)

- They have a high dividend yield

- Most have a long history of stable and growing dividends

- They are often purchased when their stock prices are depressed

Beating the TSX 2021 results

Beating the TSX doesn’t always beat the index. At this time last year, I was writing about 2020 which was BTSX’s second-worst year ever, when it lagged the benchmark TSX60 index by 15%. Of course, periods of under-performance are to be expected with any investment method, even evidence-based ones. In last year’s article, I put this sentence in bold: A good investment plan is not one without periods of underperformance, but one that is durable enough to recover and outperform.

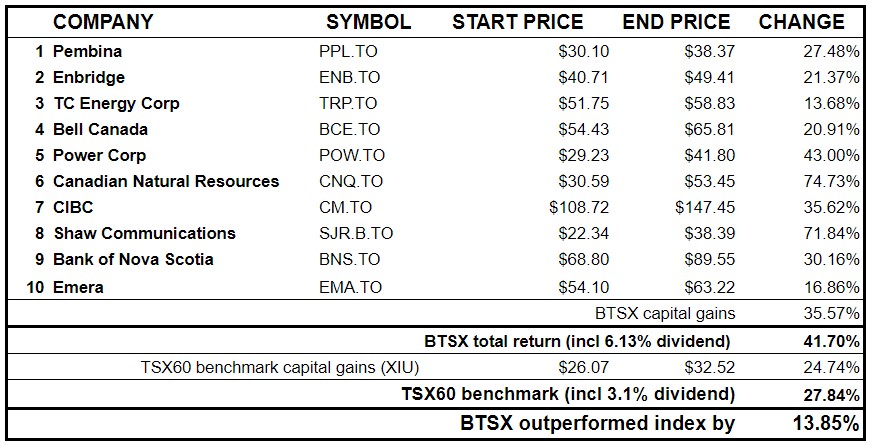

. . . And that’s exactly what has happened. BTSX investors have enjoyed stellar results in 2021. Here are the numbers and the comparison to our benchmark index (represented by the XIU.T ETF):

The TSX60 had a great year with a total return of 27.84%, but Beating the TSX crushed that number with a total return 50% higher, at 41.70%. This is the third-best year for BTSX since 1987, in terms of absolute gains. Only 1996 (54.9%) and 2009 (42.9%) posted better returns.

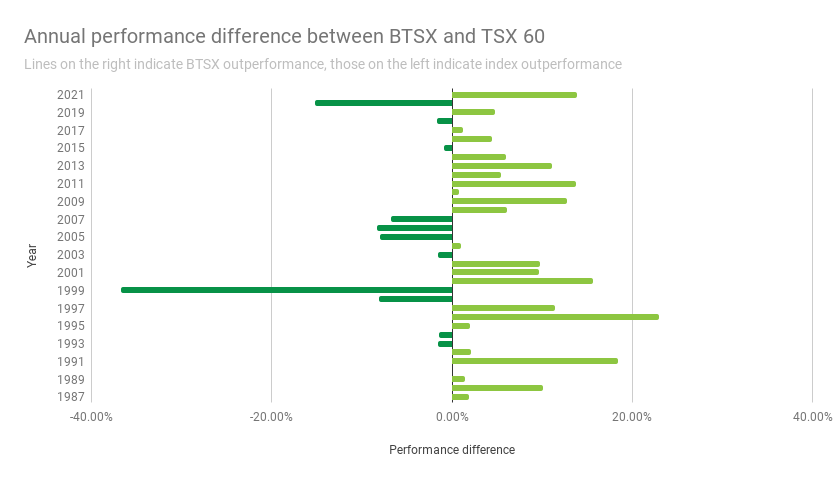

As you can see from the chart above, BTSX outperformed the index by 13.85% – a great boon for Canadian dividend investors. Since 1987, BTSX has lost to the index eleven times, tied once, and beat it twenty-two times. But only three years – 1991, 1996, and 2000 – have seen outperformance superior to 2021.

Thirty-four years of BTSX returns

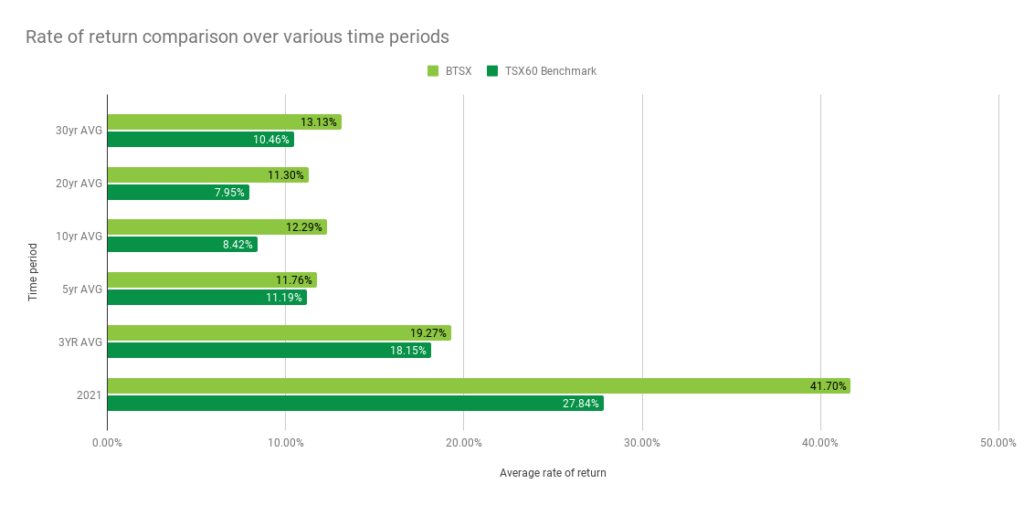

One year of great returns is a thrill, but a thirty-four-year period of better-than-average returns is where the real power is. If you had invested $10 000 in BTSX stocks 34 years ago, you would now have $369,752 – over double what a TSX60 index investor would have (in both cases total returns re-invested).

What about periods between one year and 34 years? Beating the TSX has indeed beaten the index over the last 3, 5, 10, 20, and 30 year periods. How many mutual funds do you know of with a track record like this?

High returns with some variability

Is there a price to pay for this outperformance? Of course. With only ten stocks in the portfolio, under-diversification is a valid concern. So few holdings can also lead to a higher dispersion of returns. And dividends are not guaranteed, as we recently discussed. For those reasons, many investors use BTSX stocks as part of a balanced and diversified portfolio.

Nevertheless, BTSX has a strong history of beating the index, with a few notable exceptions. The following chart shows how BTSX has performed relative to the TSX60 index year by year; 2021 is at the top and 1987 is at the bottom.

When it comes to volatility, dividend investors have a secret weapon . . . Actually, it’s not much of a secret: our dividends protect us. How? When you’re investing for dividends, it’s those payments that matter, not the stock price, and the only way to keep those payments coming is to buy and hold. This is a powerful behavioural aid helping us to stay the course when times get tough which, as we all know, is one of the biggest factors in successful investing.

BTSX Dividend Income

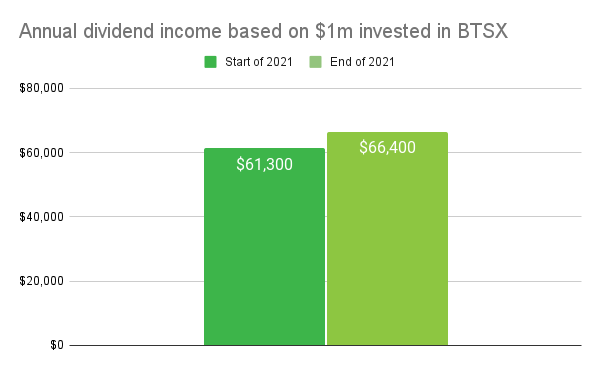

2021 was a particularly good year for BTSX dividend income. Eight out of the ten stocks raised their dividends during the year, with average dividend growth for the portfolio of 9%. If you were lucky enough to have $1 million invested in our 2021 BTSX portfolio, your anticipated dividend income for the year would have been $61 300. By the end of the year, thanks to dividend growth, that income rose to $66 400 – take that, COVIDflation.

Beating the TSX 2022

Returns aside, here is what I like best about Beating the TSX: it is simple, rules-based, and transparent. There is no special skill required, no cherry-picking stocks, no paywall.

If you are interested in trying Beating the TSX for part of your portfolio this year, why not keep your investments organized by opening a new account with Canada’s top online brokerage, QTrade? I’ve been using them for over ten years and wouldn’t think of switching. Right now they have a pretty juicy cashback offer for readers of this blog. (Using these links may result in a benefit to DividendStrategy, but the recommendation is 100% authentic)

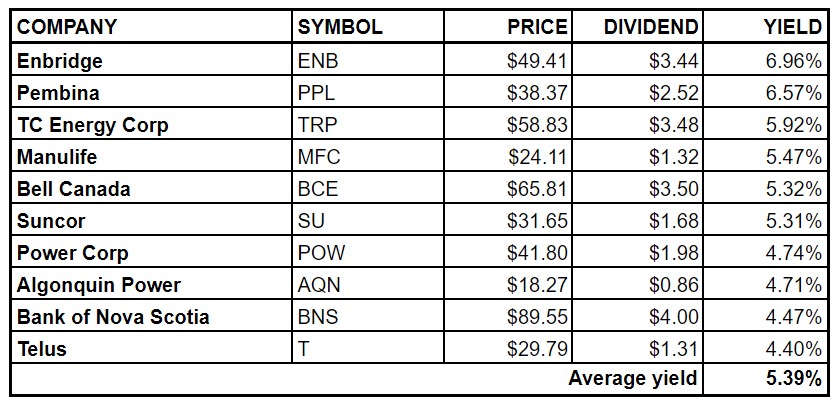

Whether you’re already using BTSX or new to the game, here is this year’s list of stocks, generated based on closing prices and yields on December 31, 2021.

If you found this post informative and/or helpful, please consider donating to help with the cost of running this blog. Don’t forget, half of all donations are given to Doctors Without Borders.

All the best in 2022! If our investments perform half as well as they did in 2021, we’ll still be smiling 🙂

Great stuff Matt.

I have bought and held many of those stocks for years, I don’t intend to sell them. That said, there is absolutely a very powerful approach here vs. owning XIU or other as benchmark. What is best about this approach: it is process-based. All good outcomes follow a good, well-designed process.

Continued success to you for the blog and more importantly, the portfolio in 2022. 🙂

Mark

I agree completely that the power is in the process. That’s what makes the method easy to stick to, thereby decreasing the “behaviour gap” (the difference between investMENT returns and investOR returns).

On that note, that’s one of the things I really like about your blog, Mark. You rightly point out that dividend investing is not magic, but it has some powerful advantages when it comes to investor psychology.

Happy new year Matt,

Amazing result from a simple method of investing, I do hold 8 out of the 10 in the BTSX ( SU &PPL) and yes I’m enjoying the nice yield and I’m planning on holding them for the long term because they’re solid companies, and here I would like to ask if you follow the BTSX religiously or you keep the one that you think are a long term holding.

Also one sector that I’ve noticed BTSX never hold is REITs but do you invest in them?

Thanks

Hi Gus. No, I don’t follow BTSX religiously. I did when I first started using it 10+ years ago, but I was earning a lot more money then, which made risky buys less risky. I also feel more comfortable assessing the riskiness of individual stocks now. I use BTSX as a tool, which is what most of us should be doing, I think.

Re: REITs – if one were to appear on the list, it would be part of the portfolio. I don’t hold them personally for a variety of reasons, but there are plenty of investors who do. It’s not unreasonable, but a much more complicated asset allocation decision than it might appear at first. Likely the topic of a blog post this year 🙂

Thank you so much Matt for your reply,

I’m also wondering if there’s a data of say the past ten years of BTSX holdings I think it will be interesting to see if most names kind of stay on the list or not .

Thanks

Stay tuned!

I mean, i suppose i know where the answer is going to land on this question but Ill ask anyways. If you were to just hold 10 stocks, all equally weighted, based on the top 10 dividend payers from the TSX60 as you’ve suggested…. what happens when you go to maintain at the end of the year and a stock has fallen out and decreased in overall value? Do you sell off and add the applicable new place holder, or do you keep the original stock and add the new entry? Obviously the top ten wont be the same year in and year out, so how do you personally manage this?

There are two posts that will help answer this more fully than I can do here in the comments:

https://dividendstrategy.ca/using-btsx-to-build-your-portfolio-a-step-by-step-guide/

and

https://dividendstrategy.ca/how-to-use-btsx-in-real-life/

Bottom line: I don’t automatically buy or sell any stock just because it appears on the list.

thanks matt

This is a great example of how this works! Consistant plan with consistant returns giving you inflation protection too! Nothing in life is guaranteed but having a plan guides you through the process! Cheers Matt! And Thanks for your dedication ! Here’s to 2022!

Thanks for the kind words, Bruce!

Thanks very much for doing this Matt, great information and post.

One quick question and my apologies if I missed it … are we running a drip on these 10 stocks in the BTSX strategy? … or are we letting the dividends pile up and saving for buying something else and/or rebalancing at a later date?

Thanks

Colin

Hi Colin, DRIPs are great, but our calculations don’t assume dividends are reinvested until the new portfolio is created the following year. Not all companies offer DRIPs, but for those that do, they are usually a very good idea. I have learned from experience that letting cash sit in our accounts makes good decision-making more difficult (shrug). But others really like the idea of having cash ready for good buying opportunities. There’s definitely a blog post lurking in these ideas – thanks 🙂

Just for fun . . . what BTSX stock will be the biggest winner in 2022??

I’ll bite. I think AQN might be the most “over-sold” at this point, but I also think they have a lot of work to do in terms of proving to the market that they’re making all the right moves. Lots of curious onlookers regarding the Kentucky acquisition. I hope to buy more in 2022.

My second favorite on the list for 2022 is POW, but whether the market will buy their take on the NAV remains to be seen. My position is full here.

Thanks for throwing your hat in the ring, James!

As always, thanks for the update Matt.

I’ve been intrigued by the conversations around following the BTSX religiously vs making individual adjustments. Here’s an example where the returns become significantly different when these choices are made: I am generally a ‘purist’ and have been following the original David Stanley method and have not been including former income trusts. And then last year, I decided to axe SJR because I’ve held it for over a decade and it has done close to nothing (yeah, I know, it’s paid me my dividend)…..well, Murphy’s law, the buyout potential came out and BOOM it jumped. As a result of owning MFC and T instead of PPL and SJR….my total return for 2021 is 32.8%, just under 10% less than your numbers.

Now…I still beat XIU! So I can’t really complain…but thought I’d share that making a couple seemingly minor changes….can have a big effect.

Regardless, I’m all in on BTSX, thanks for all you do.

I have to admit, I don’t pay a lot of attention to reports of big individual stock wins, but I have great respect for people who share their losses, regrets, struggles, etc. I’m right there with you, Chad – I owned neither SJR nor CNQ last year, but our returns were still great and I slept better all year long 🙂 Another excellent reminder that a rules-based investment approach is generally superior to one based on human judgement.

Yes exactly, Matt. Whenever I try to overthink things instead of just trusting the process…I more often than not get disappointed. With 12 yrs of BTSX now for me, I am more and more just going to try to stick to the standard. And I’m more than happy to share my mistakes – it’s how everyone on this blog comments section can learn, myself too. I have learned so much from my mistakes and for the most part have eliminated them moving forward…and my portfolio has benefitted from facing them head on and making appropriate changes.

Great content! If one were to start this strategy (Moving dollars from other investments – mainly index funds) How do you recommend one starts ? Pick the 10 and buy them or is further caution warranted ?

DSB, if I were in your position I’d assess how my index funds performed relative to the BTSX performance, and I’d also consider where those funds are invested (e.g. USA, Canada, emerging markets, etc.).

I assume you mean ETFs. If you mean mutual funds, then that’s another story.

After this assessment, and assuming BTSX out-performed your Canadian investment index funds I’d be inclined to replace those funds with stocks from BTSX. If you have some funds in a non-registered account it’s a tougher decision because then you might have to weigh the capital gains tax that might be due as a result of selling your existing holdings. If your index funds are all in an RRSP or TFSA then this isn’t a concern.

I think BTSX is a great way to invest the Canadian portion of your portfolio, but it’s wise to diversify as well.

I’ve been following BTSX for about 20 months now, and like many I use it as a guideline. I also never bought CNQ, and while I held SJR for a while I sold it long before the Rogers deal was announced. Such is life. I went all in on 8 of the other names from last year, and then had to replace BPY as I sold before the final transaction – so I did okay.

We also hold a couple of REIT’s. Our current average yield is 5.88%.

Thank you James. Could you elaborate what you mean as a guideline ? Does that mean select the stocks you are more comfortable with and add a couple of your own ?

Hi James. How do you find out when a stock or company cuts its dividend? Do you have a resource, service or internet link that you can go to for this…and if so…what is it? Does this service alert you somehow by reports or notifications? I am just starting out on my BTSX journey and don’t want to hold to a stock long term if it cuts its dividend.

Pingback: Making sense of the markets this week: January 9 - DailyBusiness

Pingback: Making sense of the markets this week: January 9 - Veritas World News

Pingback: Making sense of the markets this week: January 9 - The Ali Post

Pingback: Making sense of the markets this week: January 9 – Loonie.com

Pingback: Weekend Reading – Important numbers for 2022 edition - My Own Advisor

Pingback: How to Beat the TSX (BTSX) - My Own Advisor

Great piece