There has been a lot of discussion here recently about whether or not certain stocks should be included in the Beating the TSX portfolio. IPL, PPL, and BPY-UN have all landed on the list in the last few months. Some investors see a place for these stocks in their portfolios while others look at their payout ratios or dividend histories and argue that some companies are just not worthy of the BTSX label. Beating the TSX is a rules-based investment strategy, so the question is: Is it time to change the rules?

The criteria for inclusion in BTSX is simple: be listed on the TSX60 with a top-ten dividend yield. Historically, the list has been re-constructed on an annual basis; this is still what I and many BTSX investors do with our own portfolios. On this site, however, I publish an updated list monthly – not to encourage more buying and selling, but to accommodate those investors who are just getting started or who have cash they want to invest now.

One of the primary goals of this blog is to help investors understand that managing their own investments is not just possible, but a very reasonable undertaking. In considering the investment method we choose to use, it’s worth remembering how we got here.

Why do we become DIY investors?

The reasons will be variable, but I would wager that there are common themes. One of these is that we just don’t buy into the mutual fund model. Not only do we rail against exorbitant fees, but we understand that those fees don’t correlate with improved performance. The science is clear: active management doesn’t work. Why not? Two main reasons:

- Markets are mostly efficient, making it effectively impossible to predict individual winners and losers on a consistent basis

- Behavioural finance has revealed unequivocally that humans are hard-wired to make all kinds of investment mistakes due to completely unavoidable behavioural patterns called cognitive biases

So, we come to the correct conclusion that we can invest our own money. It doesn’t have to be complicated; indeed, simple systems like dollar cost averaging into index investing or Beating the TSX tend to perform better. A simple methodical approach is the most effective way to sidestep those dangerous cognitive booby-traps like anchoring, loss aversion, and confirmation bias.

So, we reject expensive professional management and adopt a rules-based approach. Make a plan, pay less fees, accumulate wealth. It’s empowering.

Five of the most important benefits of a rules-based investment plan:

- Evidence-based: rather than going rogue and investing on whims, BTSX is supported by decades of data

- Avoid the behavioural gap: this is the difference between what investments return and what investors make, and it’s due to those cognitive biases that we just can’t escape unless we are following a rules-based approach

- Focus on process not outcome: we can’t control outcomes, but we can control process – make that process as evidence-based and effective as possible

- Easier, less time-consuming: BTSX is simple; trying to figure out what the stock market is going to do is

hardimpossible - A solid foundation: making a rules-based approach the foundation of your plan makes it easier to customize the details

“But what about Stock X??”

Having said all that, stocks will appear on the BTSX list that we are not comfortable with. In fact, a little digging will uncover all kinds of reasons to be negative about any stock. Whether you make an investment or not depends on whether you value the positives or the negatives more. But, certainly, given the value we place on stability of dividend payments, there are some companies that are more worrisome than others.

If you are not comfortable holding a particular investment, don’t buy it – I have always said this. BTSX is a tool we can use to build a portfolio of dividend paying stocks, but it is not a doctrine that must be strictly adhered to. On the other hand, making individual decisions that best suit your plan is different than changing the actual BTSX method. Beating the TSX has a 30+ year history of out-performing the benchmark index using very simple criteria. If we change those criteria, what good is that thirty year history?

Investment integrity

Some of you may be wondering why I am willing to include “lower quality” (by some estimations) stocks in BTSX when they pose a potential risk to our track record. The answer is simple: I am the steward of the BTSX method, not a manager of returns. Fundamentally, this is what sets BTSX apart, and abandoning those values of simplicity, consistency, and accessibility would undermine the entire BTSX project.

So, to those of you who objected to IPL based on it’s payout ratio, or dismissed BPY-UN because of its short dividend history, I hear you. In fact, I share your reservations. But here’s why I will not be changing the Beating the TSX method:

- BTSX is now a pure list. The last seven years had excluded previous income trusts, but that anomaly has now been resolved to put BTSX back in line with the original method. This means that there are no additional filters or decisions to be made. It is transparent and accessible to investors of all skill and comfort levels. The list is the list, and it comes with a thirty year track record.

- I am not an active manager. I can not predict the future, and I’m guessing you can’t either. Sure, IPL, PPL, and BPY-UN have taken a beating, but who is to say that next year they won’t be big winners? I know I can’t predict these things; if you think you can, I challenge you to write down ten stock market predictions right now, then check them in a year. You might be surprised at your inaccuracy (but at least you can take solace in the fact that you’re not alone).

- There are experts poking holes in every stock on the list. There always have been. Heck, that’s why many of these stocks are on the list in the first place. But every stock has a time to shine; the trick is to buy before it enters the spot light.

- BTSX is a tool, not a dictum. If there is a stock you are really uncomfortable with, just skip it and buy the next one on the list. Maybe you’ll do better, maybe you’ll do worse, but either way you’ll sleep better. And if you systematically alter the method (avoid companies with payout ratios over 80%, for example), you can track your results (and I will he happy to publish your data).

This post has been several months in the making. I know a lot of you were waiting to hear whether or not BTSX would be altered going forward. I hope this answer is sufficient in both clarity and detail, even if it may not be 100% agreeable to all.

Lastly, I’d like to thank David Stanley and Ross Grant, the previous authors of Beating the TSX, who were both happy to engage in a detailed discussion of this tricky issue. It is validating that all three of us came to the same conclusion.

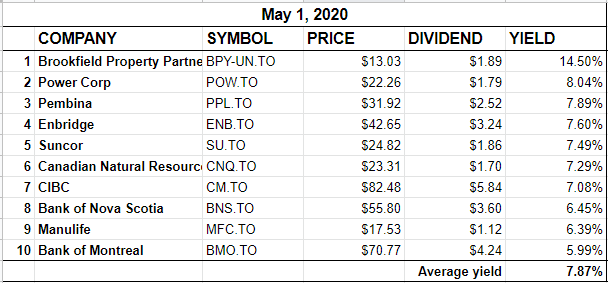

BTSX May 2020 Portfolio

I wanted to stay away from market commentary this month . . . but, wow, what a snap back. Even though the stocks on our list haven’t changed from last month, what has changed are the dividends – surprisingly, four of them increased (BPY-UN, POW, CNQ, and CM). So, even though stock prices have gone up, the average yield is still high because of these increases. BCE, which occupies the 11th spot this month, also raised its dividend. Let’s hope the majority of these increases are a sign of strength and not wishful thinking.

Stay safe and happy investing.

As usual very informative about the BTSX formula and rationale. I have been a dividend investor for many years. I differ somewhat in wanting my Canadian holdings to have significant revenue coming from outside Canada. My USD$ holding have inched higher and close on 25%. No dividend tax credit but the growth has been better. Sector allocation is also a major consideration.

I think the important point is ultimately what you mention about BTSX being more of a guide than anything. With decades of data to suggest it is a successful strategy, simply going forth by following it may well lead to superior returns in the future, but there is no moral imperative that this must be done unfailingly.

This is a difficult period to make predictions with any degree of certainty. Oil has been absolutely hammered, along with everything COVID-19 has brought with it, so companies like SU have a multitude of issues facing them.

By the end of this period, the truest of quality will be shining through.

Take care,

Ryan

Publishing previous BTEX portfolio could be an option and let new investors decide if they buy new titles on the list or the ones removed. Personnally, i would appreciate seeing actual portefolio, portofolio at 31 decembre 2018 and 2019, one next to the other like financial statements are doing.

Thx for the BTEX, it is very interesting.

I think it is even more useful to have access to the whole TSX60 index listed by dividend yield so that you are not relying on historical data. That is why I made this.

However, if there are a significant number of other readers who would like the annual BTSX portfolios published all in one place, I will consider it. In the meantime, you can find the 2018 and 2019 portfolios here.

Thanks for the feedback.

Being that I am fairly novice at investing on the whole, I would love to see annual lists somewhere. I am only beginning to learn about payout ratios, FFO, EPS and other metrics etc. I would argue I rely heavily on outside analysis of these numbers and what they mean rather than be able to look at statements and develop my own conclusions.

In saying that, I would absolutely love annual (static) lists as I feel they represent “stability”. Meaning, what was on the list on January 1 2019, January 1 2020, January 1 2021 are more likely to be the same rather than say if I tuned in March 25 this year I suspect that list looked quite different (I could be wrong). This would kind of get rid of the “noise” of the volatility in between years… Just a thought from a new reader 🙂

Thank you for all the hard work on this site.

Well said. Agreed

Hello,

Your website has piqued my interest in dividend investing. Thanks for the great information!

I was wondering, how do you manage price depreciations?

For example, say I invest in the top 10 yield companies from TSX60, how do you manage share price drops? A 10-15% drop in share price (and if it stays that way for the year) can easily make the dividend income from the company for the year basically a wash. And when it comes time of the year to review the BTTSX list, would you sell this company at a loss if it’s no longer one of top 10? Thanks!

Hi KC, I think you will find this post useful.

As for prices that have dropped, the only way this affects my investing behaviour is if I might consider buying more. I feel quite strongly that investment decisions should not be made based on what has happened, but on what is reasonable to expect in the future. In fact, that is the definition of an investment, and the fair value of an investment is the present value of future distributions discounted at some rate. Therefore, if future earnings and dividends are solid, a lower current price is a good thing if we can buy more shares. The underlying assumption in all of this is that we are long term investors, not speculators.

Good question – and I know others are thinking it. Hope that explanation helps.

Hi,

I recently found out about the BTSX strategy. Great website by the way.

I understand the goal is to once per year pick the top 10 stock with the highest dividend yield and buy in equal amount.

However I did not find information about monthly contributions. Let’s say I will add 1000$ per month to my BTSX portfolio. Is there a guideline or statistics saying if it is better to buy those exact same stock until the end of the year or if I should rather each month check if the top 10 changed and rebalance each month if needed. I do not pay any fee to buy or sell stocks.

In short, if I add money monthly, should I stick with only rebalancing once per year or I can do it each month? Or does it matter at all?

Thanks!

This is the space where you can exercise your own judgement. There are several good options: accumulate cash and buy annually, use the cash to rebalance a stock or stocks that have become cheaper, or buy an index ETF monthly until your annual portfolio update – those are just a few of the options that come to mind. No dogma on this site 🙂

Pingback: The most important investment spreadsheet for dividend investors —

Pingback: Beating the TSX 2020: looking back and staying the course —

Pingback: Should I use stop loss orders? —

Pingback: Mutual funds are a tax on uninformed investors – moneySmartMD