Organisms can position themselves in one of two ways from an evolutionary perspective: specialize or generalize. Specialist species are adapted to a narrow range of conditions. They are specialized for their niche and out-compete other species in that space. Specialists thrive when conditions are just right, but suffer the most when conditions change. Think of giant pandas, venus fly traps, or koalas.

Generalist species, on the other hand, are able to survive in a wide variety of environmental conditions and can make use of a variety of different food sources. It’s hard being a generalist because they are not optimally adapted to any one environment. They are constantly out-competed by the specialists because they are not the most efficient or successful in any one niche. When conditions change, however, they are able to switch tactics, eat different foods, defend against different predators, and tolerate different climates. Think raccoons, cockroaches, and coyotes.

Change is the only constant

Over the last 450,000 years – a blink of an eye in evolutionary terms – our planet has had four ice ages. Four periods lasting tens of thousands of years where North America was covered in ice about 10,000 feet thick. We are living in a Goldilocks era. Conditions always change. Given that, what type of species do you think are more likely to survive?

If you are a specialist, all change is adversity. If you are a generalist, change may mean adversity, but it may also mean opportunity because the specialists are almost always suffering even worse. The ability to survive and compete depends on having choices. And how many choices you have depends on how you have positioned yourself on the spectrum between specialist and generalist.

I learned about these evolutionary concepts in university. I didn’t see how universal they were. A close friend sent me the following piece by Shane Parrish on the topic. It is as beautifully written as it is profound.

One of the most overlooked opportunities in life is how you are positioned when circumstances hit.

Good positions create options, while bad positions reduce them. You don’t have to be an expert decision-maker to get better results, you only need to put yourself in a good position. Anyone looks like a genius when all the options are good.

If you’re forced to do something because you need to and not because you choose to, things quickly spiral from bad to worse.

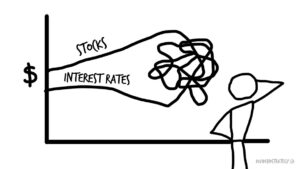

The person in the good position eventually takes advantage of the person in the poor position. As one example, many people bought the biggest and most expensive house they could afford over the past five years. In an environment of low-interest rates, a booming economy, and house price increases that rival investments that didn’t seem like a bad idea at the time. Things change quickly. The very same person now might find themselves forced to sell their house at the worst time. Another person — one who didn’t go all in on a house — is thinking about buying today to take advantage of the opportunities.

Good positions are expensive, but poor ones cost a fortune. Spend less time worrying about maximizing your immediate results and more time maximizing your ultimate results. Giving yourself options in the future always appears suboptimal in the moment. Putting yourself in a good position for tomorrow means paying today. This might mean a lower return, living below your means, or sitting on the sidelines when everyone else is having fun.

Poor positioning kills more dreams than poor decisions. Decisions matter, but it’s easier to make good decisions when all your options are great.

That was from “Brain Food”, a weekly newsletter published by Canadian, Shane Parrish, through his Farnam Street project. I listen to his “Knowledge Project” podcast regularly. Every time it makes me feel both a little wiser and a lot more certain of my enduring ignorance.

Good positioning is hard work, but bad positioning can be fatal.

The reach of this concept is staggering. One might live by this sentence alone: “Good positions create options, while bad positions reduce them.” Most of us already know this and put the philosophy into practice without thinking about it.

Why do we teach our children to be considerate and polite? Because good relationships give us options.

Why do we encourage a broad-based education? Because a well-rounded mind is more resilient, versatile, innovative and employable.

Why do we save our money? Because financial independence put us in a position where we control our time and are free to do what we think is important (aka a position of f*#k you).

Why do we diversify our investments? Because there is always a risk that any one asset, country, or stock could fail. The first priority of financial planning is survival, not hitting a home run.

It might be easier to put all your eggs in one basket, but baskets break. A better strategy is to get used to carrying more baskets.

There will always be a role for specialists because we need them. They reveal optimizations and move us forward. But specialization and vulnerability are two sides of the same coin.

Specialists are really good at one thing. Crypto Crusaders sounded pretty damn smart for a while when “conditions were just right”. Real estate investors in Toronto and Vancouver looked brilliant when interest rates were low and prices kept rising. Whether it’s crypto, real estate investments or stock options, there might be a role for unique portfolio assets, but our chances of generating long-term wealth are far greater if the bulk of our portfolio is based on simple, durable rules.

Investor positioning

The most successful investors in the short term are always specialists. Try not to compare yourself to them. Investors who focus on a narrow segment of the market will appear brilliant when that segment outperforms. But in the long run they will almost always be disrupted by shifting markets, world events, and changing sentiment.

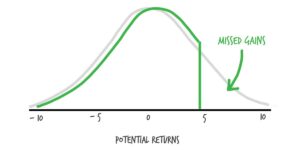

Generalist investors use a few rules to guide their behaviour, big rules that don’t hinge upon current circumstances (ex. buy and hold, stick to asset allocation targets, don’t use leverage, avoid stock-picking, etc.). They may be involved in the specialist’s niche, but that involvement will be limited. As such, their performance in the short-term will always be less than at least one group of specialists, but averaging over many cycles and environments, they are likely to not only survive but prosper.

In investing, specialization is a bet that circumstances won’t change, or they’ll change in a way that you can predict. Generalist investors are also making a bet, but they are making a smarter bet, that things will change in ways that can’t be reliably predicted. Short-term underperformance then becomes a simple price that must be paid for long-term outperformance.

How to improve your position

This concept of optimizing your position rather than your tactics is applicable to more than just investing. It’s a secret weapon that can build strength and resilience in many areas. Here is a short list of actions I think we can take to improve our positioning in life. Please feel free to add to it in the comments – I would love to hear your thoughts.

- Learn broadly – you never know what you’ll need to know

- Take care of the people around you – you need them as much as they need you

- If you can’t be kind, be professional – don’t burn your bridges

- Be humble – we see more clearly with an open mind and an open heart

- Take care of your health – a functioning mind and a capable body are the most valuable assets you have

- Live below your means – unless you save money you will always be a slave to it

- Don’t take risks you don’t need to take – once you have positioned yourself well, don’t squander that position by taking unnecessary risks

Thanks for indulging me this week, folks. For me, there is no better way to explore these ideas than to write about them. I’ll leave you with a quote by Anne Frank:

Our lives are fashioned by our choices. First we make our choices. Then our choices make us.

If you would like to support this site, click here:

In case you missed the email, Qtrade has just released a new offer for new and existing clients who open a new account – up to $2000 cash back! This offer is only available through select Publishing Partners, of which DividendStrategy is one. Click the image below to check it out:

“Love begins at home, and it’s not how much we do, but how much love we put into the action that we do.” St. Mother Teresa, Nobel Peace Prize lecture, 1979.

Being well-positioned helps avoid TINA (there is no alternative). With alternatives, you have options that create opportunities. So makes good sense.

Also, I was always taught better to be a specialist than a generalist. Our society pays specialists more and they have better job security & less competition. If you are really expert at any one thing, you can pay and get everything else done for you. I’m still not certain if it’s better to be a specialist or generalist today with the way our society functions. Perhaps a generalist with breadth?