The same blog . . . only better

I started DividendStrategy.ca almost three years ago with the first ever online Beating the TSX…

It's up to us to teach our kids about money: the 5 pillars of money mastery

Last week I wrote a post outlining the reasons why educating children about money…

Dear school: please don't teach my kids about money

When I was a high school student, I learned all about the human body's circulatory…

Stop saving for retirement. Start saving for financial independence.

Retirement planning is a multi-billion dollar industry. If you are conscientious enough to save, there's…

Dividend investing and interest rate uncertainty

I have a confession to make. I look for reasons not to be a dividend…

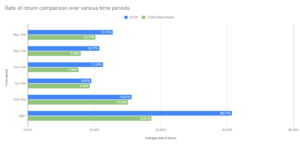

BTSX 2021 mid-year update: back on track

2020 was a tough year for dividend investors and those of us who use the…

Should you invest in segregated funds?

Segregated adjective set apart from each other Segregated funds noun products designed to separate investors…

The real problem with financial advisors

The road to financial independence and through retirement often feels like a menacing dark alley…

Should I use stop loss orders?

No one likes to lose money. It would seem totally reasonable, then, to use stop…

Using BTSX to build your portfolio: a step by step guide

Dividend investing, and Beating the TSX in particular, have an excellent long term record of…

Should you invest for dividend yield or dividend growth?

You’ve seen the evidence that dividend-paying stocks outperform non-dividend paying stocks. You want to take…

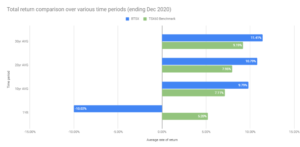

Beating the TSX 2020: looking back and staying the course

To bear trials with a calm mind robs misfortune of its strength and burden.Seneca Last…