This article will be appearing in the February 2023 edition of Canadian Moneysaver Magazine

So long, 2022. Don’t let the door hit you on the way out.

Many investors feel burned by the past year. Household mega-cap tech stocks like Facebook, Amazon, and Netflix crumbled before our eyes. Crypto-currency investors did even worse; at this point, over half of Bitcoin investors are in the red. But the pain was not limited to a few risky sectors. Even balanced portfolios got sucker-punched – never before have both stocks and bonds suffered 10%+ declines in the same year. There was no escape.

But as we bid farewell to 2022 and step cautiously into 2023, the chest tightness and sweaty palms are probably still with you. Inflation is battering our bank accounts and undercutting the real value of our long-term savings. Central bankers have all but promised a recession. And COVID just refuses to go away.

What do you do as an investor when you’re surrounded by so much uncertainty?

Very little, I hope.

When “normal” doesn’t feel good

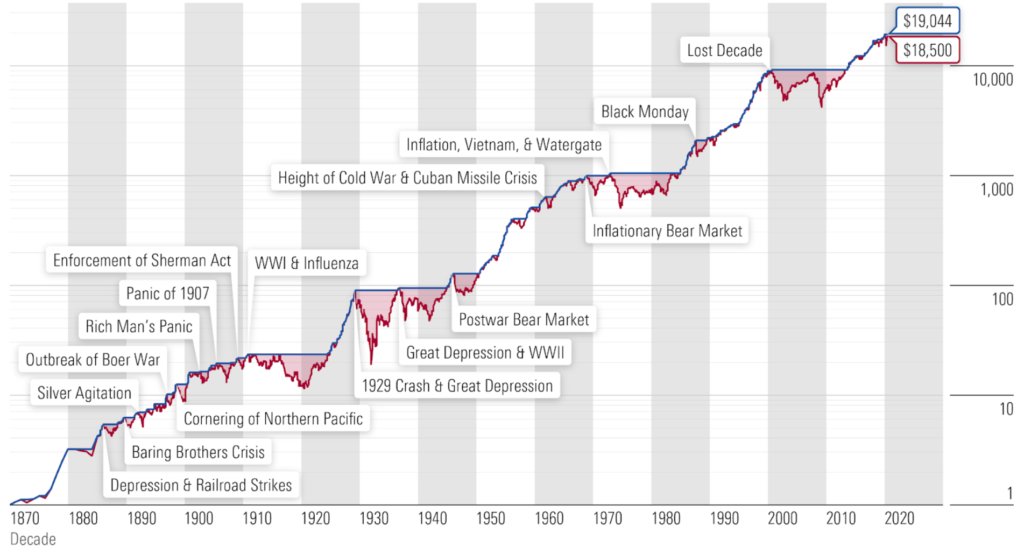

My suggestion is to take a step back and realize that 2022 was normal. That’s right. The details differ from year to year, but uncertainty is normal. Periods of high inflation are normal. Bear markets are normal. Political turmoil is normal. They don’t always happen at the same time but, then again, sometimes they do. Being a stock investor might feel like you’re playing in traffic but, guess what – stocks live and grow through dangerous and uncertain times. This is one of my favourite charts showing that they always have and they always will.

If you have designed your investment plan with any reasonable amount of historical context in mind, then it was made for this. The success of your plan hinges on sticking to it through the hard times even more than reaping benefits in the good times.

For me, one of the greatest advantages of being a dividend investor is a focus on income rather than stock prices. You can reinvest that income or use it to put food on the table but the point is this: while stock prices change quickly (and, as we’ve seen, bond prices can too), dividends from blue-chip companies have very little volatility – and, in general, they go up.

There is significant evidence that dividend-paying stocks have historically outperformed non-paying stocks both in Canada and around the world. But how can individual Canadians go about building a portfolio of high-yield dividend-paying stocks?

Enter Beating the TSX

Created by David Stanley in the 1990s, BTSX is a simple method that anyone can use to identify Canadian blue-chip dividend-paying stocks that might be worthy additions to your portfolio. I’ve been using the method personally since 2008 and writing about it since 2018. Here is the process:

- List the stocks on the TSX60 by dividend yield.

- Purchase the top 10 yielding stocks in equal dollar amounts

- Hold for a year and repeat

The method usually results in a portfolio of stocks with several appealing characteristics:

- They are large and usually stable companies with low volatility

- They have a high dividend yield

- Most have a long history of stable and growing dividends

- They are often purchased when their stock prices are depressed

Beating the TSX 2022 results

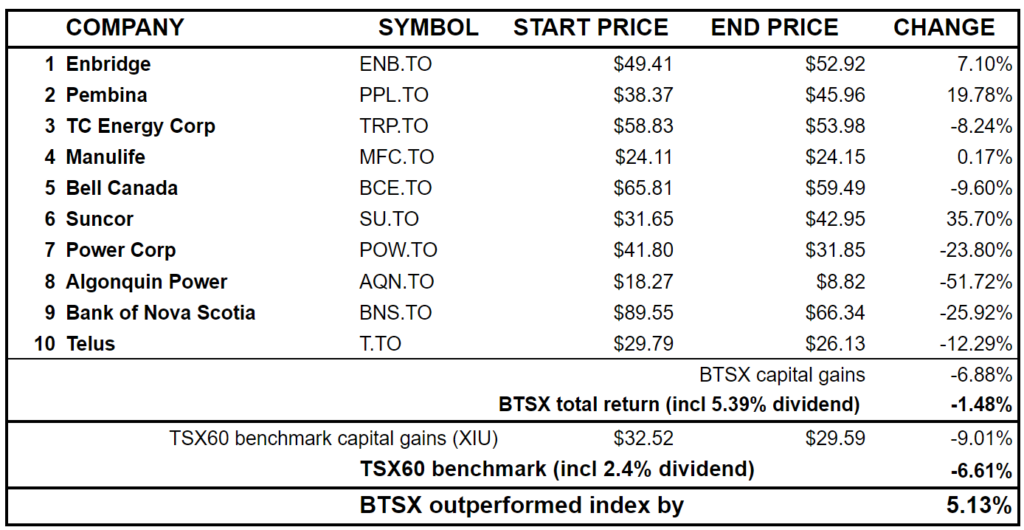

A year ago I had the pleasure of writing about 2021 which was one of BTSX’s best years ever with a total return of 41.7%, beating the index by 13.9%. After a year like that, I was mentally prepared for some reversion-to-the-mean pain, but BTSX has come through again with a total return (price + dividends) of -1.48% vs. -6.61% for the benchmark TSX 60 index, represented by the XIU ETF.

Up until the last few weeks, BTSX was still in positive territory but the recent AQN debacle narrowed the gap between our portfolio and the index and put BTSX in the red for the year. The end result is that BTSX was still able to beat the index by 5.13% even though both are in negative territory.

Variability among BTSX stocks

Many of us tend to think of BTSX stocks as a homogeneous group, but it’s instructional to see how variable the returns are within the portfolio in any given year. This year the gap between the biggest winner (Suncor) and the biggest loser (Algonquin) is a whopping 88%. One might be tempted, as I have been in the past, to try to predict who the winners and losers might be ahead of time and apply some kind of filter. But what I have found is that, more often than not, my efforts are rewarded with a nice big piece of humble pie rather than superior returns. The simple and perhaps unsurprising truth is that BTSX is not just better than most mutual fund managers at selecting stocks (net of fees), but it has also done much better than me.

Rather than being disappointing, I have found this to be liberating.

Thirty-five years of BTSX returns

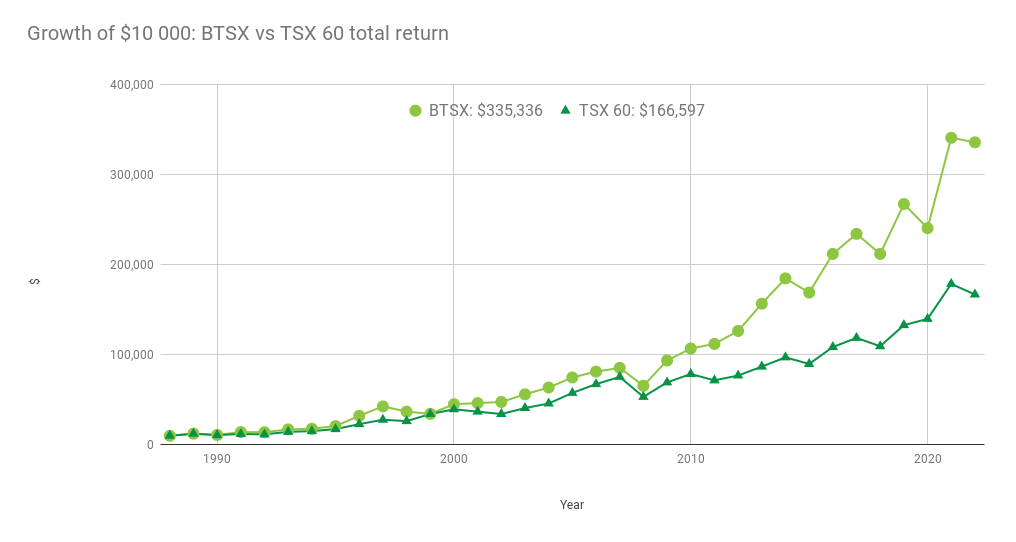

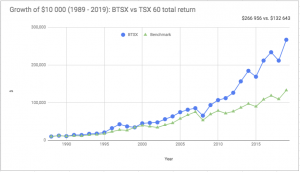

Why liberating? Beating the TSX has had its ups and downs, but the long-term performance of this simple, hands-off approach has been nothing short of spectacular. If you had invested $10,000 in BTSX stocks 35 years ago, you would now have $335,336 – over double what a TSX60 index investor would have (in both cases total returns re-invested).

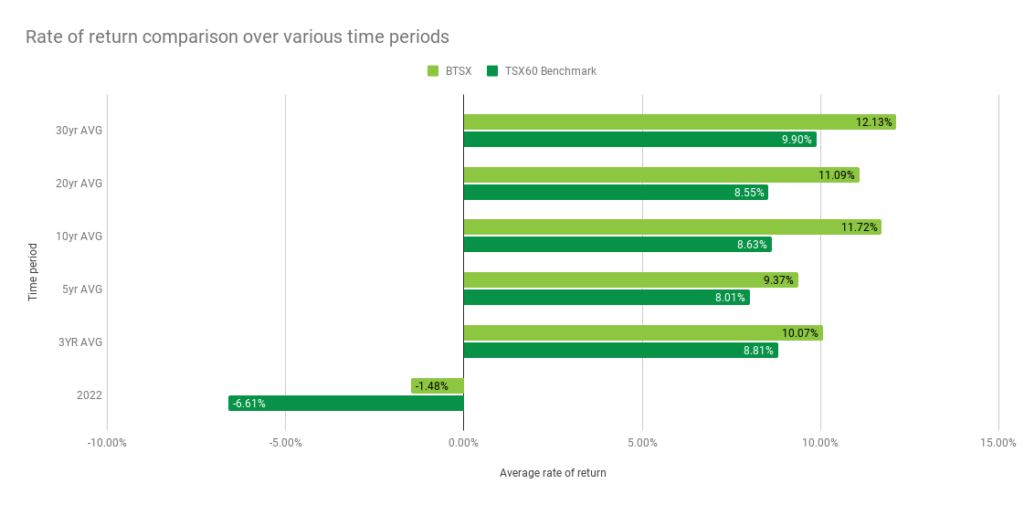

What about periods between one year and 35 years? Beating the TSX has indeed beaten the index over the last 3, 5, 10, 20, and 30-year periods. How many mutual funds do you know of with a track record like this?

Realistic expectations

If Beating the TSX was a mutual fund, the fund company would be plastering those long-term performance numbers all over the place. But I’m not selling a portfolio. My goal is to help other DIY investors and the best way to help is to provide balanced information. If you’re considering using BTSX, you’ll be more effective if you understand a few challenges and limitations:

- It can be hard to hold BTSX stocks. The overall long-term results have been great, but, as you can see from 2022, some stocks are going to fall in price – sometimes by a lot

- Some stocks may cut their dividends. This didn’t happen in 2022, but it does happen on occasion and investors should have a plan for this

- BTSX stocks tend to be concentrated around a few sectors. Further diversification is warranted.

- BTSX stocks don’t always beat the benchmark

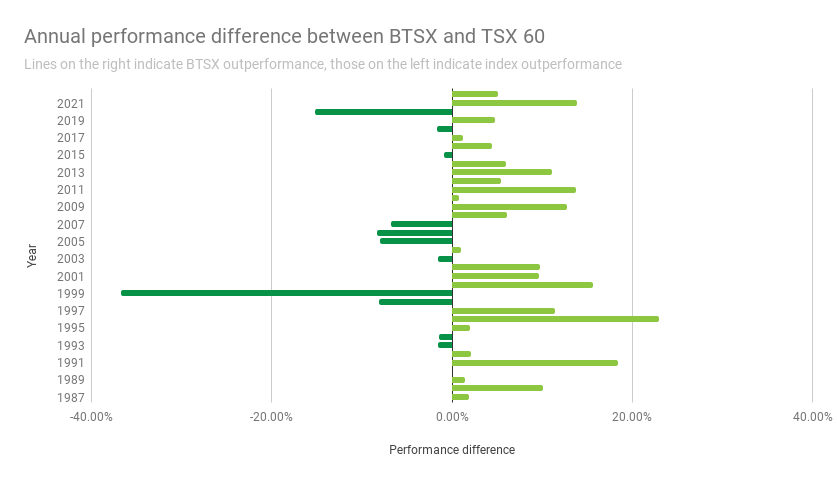

The last point is particularly important: Beating the TSX is not a sure thing. I talk to many investors who are very keen to use the BTSX method based on the long-term outperformance but haven’t appreciated that BTSX, like any investment strategy, has and will continue to have periods of underperformance. The following chart shows how BTSX has performed relative to the TSX60 index year by year; 2022 is at the top and 1987 is at the bottom.

Just like any stock investor should be prepared for prolonged downturns in equity markets, BTSX investors should be prepared for periods of underperformance, particularly in the short term. But as Charlie Munger has said, “It’s waiting that helps you as an investor and a lot of people just can’t stand to wait.” BTSX investors who have waited out the rough patches have been rewarded.

The good news is that, when it comes to volatility, dividend investors have a secret weapon . . . Actually, it’s not much of a secret: our dividends protect us. How? When you’re investing for dividends, it’s those payments that matter, not the stock price. And the only way to keep those payments coming is to buy and hold. This is a powerful behavioural aid helping us to stay the course when times get tough which, as we all know, is one of the biggest factors in successful investing.

BTSX Dividend Income

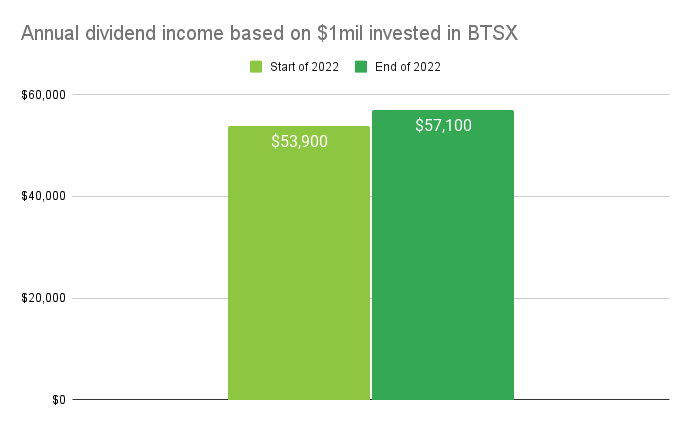

2022 was another good year for BTSX dividend income. Eight out of the ten stocks raised their dividends during the year, with average dividend growth for the portfolio of 6%. If you were lucky enough to have $1 million invested in our 2022 BTSX portfolio, your anticipated dividend income at the beginning of the year would have been $53,900. By the end of the year, thanks to dividend growth, that income rose to $57,100. How’s that for inflation protection?

Beating the TSX 2023

The media is going to keep feeding us reasons to be fearful: COVID, inflation, recession, etc. – that is how they keep our attention and, therefore, their advertising revenue. But when has there ever been a period of time without uncertainty? The only thing that’s certain is uncertainty.

But decisions made under stress are almost always worse than those made with a clear head. So, take a step back, and ask yourself two simple questions:

- Do I have a clear investment plan?

- Is it designed to carry me through the uncertainty?

The best thing about Beating the TSX is this: it is simple, rules-based, and transparent. There is no special skill required, no paywall, and no need to adjust the plan based on world events or business cycles.

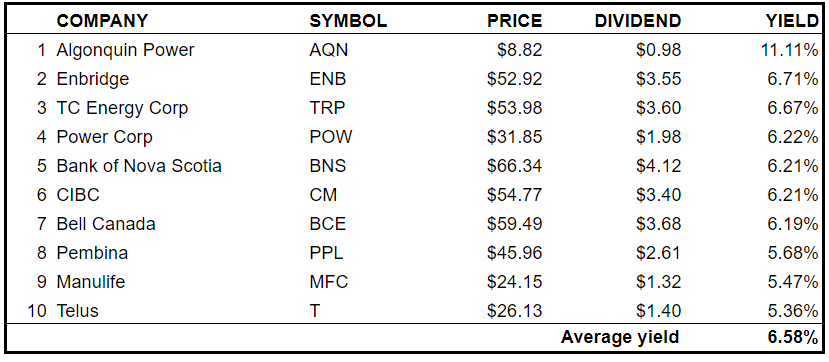

Whether you’re already using BTSX or new to the game, here is this year’s list of stocks, generated based on closing prices and yields on December 31, 2022.

2023: Enter with caution

I’ll end this update with a word of caution. AQN sits at the top of this year’s list with a yield of 11%. The reason the yield is so high is that AQN’s stock price has been cut in half in recent months. As I write this on January 1st, the board has not announced a dividend cut, but that seems to be what the market is expecting and, personally, I wouldn’t be surprised by one at all.

So, when you are constructing your portfolio for 2023, bear in mind that dividend yields are not a promise of future income. Rather, they are simply a reflection of the latest dividend announcement from the company’s board. BTSX is a tool to identify potential investments, not an instruction manual.

If you are not comfortable owning AQN or any of the other stocks on the BTSX list, that’s okay. You can simply leave them out, go to #11 from the TSX 60 list (currently EMA), or perhaps seek out a good dividend-growth stock from another sector to improve your diversification. Whatever your choice, it is important to build the portfolio you’re going to be able to stick with through the inevitable uncertainty we are all going to encounter.

If you would like to support this site, you can do so HERE. If you’d like to talk about how I might be able to help you as a money mentor, you can find out more HERE, or send me an email.

In the meantime, I wish you all the best in 2023!

I really appreciate your simple and sound advice. Great writing with evidence-based conclusions. Thanks.

There is one part of the BTSX strategy that seems inconsistent. You state:

‘When you’re investing for dividends, it’s those payments that matter, not the stock price. And the only way to keep those payments coming is to buy and hold. This is a powerful behavioural aid helping us to stay the course when times get tough which, as we all know, is one of the biggest factors in successful investing.’

Yet, every year you *may* end up selling particular stocks that have dropped off the Top 10 list, and replacing them with newly arrived Top 10 stocks. Can (has) this mild churn negatively affect performance over time?

Thanks and best to you and all in 2023.

Hi Tim, I’m glad you wrote this comment and completely understand why this might be confusing. So, let me try to clear it up.

The first thing to understand is that many people who use BTSX, including me, prefer not to sell companies that have fallen off the list as long as they still fit within one’s investment plan. I have found this to be a good way to build my portfolio of 20 – 25 Canadian stocks over time.

The other important point is to understand that “buying and holding” doesn’t have to mean strictly holding the exact same stocks. If your investment plan is to hold 60% stocks, 30% fixed income and 10% cash, for example, your 60% stocks may get some internal adjustment with your annual portfolio maintenance. In my opinion, this is not much different than rebalancing one’s portfolio back to target allocations. What is NOT an effective strategy is to adjust ones asset allocation based on predictions of what markets are going to do, i.e. selling stock and holding more cash “until the dust settles” . . . because, well, the dust never settles.

Thanks for raising this point. I hope my explanation helps.

Hello Matt,

Thank you for all you do I always look forward for a new post! Now I hold 10/10 in the BTSX after CNQ have dropped out of the list 🙂 Like you said regarding AQN or any other company there’s no guarantee in life nevermind in the market there’s that risk that we take as investors and although a lot of things are out of our control some are like making sure to keep our holdings under a certain percentage so in case something goes wrong with that company it won’t be big enough to crater your portfolio.

Again thank you so much Matt for your efforts on this site and all the best in 2023.

Such kind words – really appreciate it, Gus! And it sounds like you understand exactly what I mean by embracing uncertainty and preparing for it at the same time.

I enjoy this site. If the stocks selected does not meet proper diversification what ETF would you add for proper balance.

Thanks

Ivan

I can’t give specific investment advice, but I can offer a way to think about this. Start with your overall asset allocation. Once you know how much of your portfolio should be in equities, decide on your allocation to Canadian vs US vs International. I like using index ETFs for all of my international exposure. Vanguard, Blackrock and BMO all have good options. Then, for Canadian content, you have choices. I complement BTSX stocks with dividend growth stocks from other sectors. You could also use a broad-based Canadian ETF, knowing that you’ll be duplicating some of your BTSX holdings. I’m not aware of Canadian ETFs that exclude financials, utilities and telecoms – the usual BTSX players.

I’ve been toying with the idea of offering a third mentoring option: DIY Dividend Portfolio Construction. I think I could do it for about the same price point as Option #2. Would love to hear feedback on this idea.

Hi Matt, I have a question about BTSX, I started investing in BTSX in 2022, I allocated $1,000 to each stock for 2022.

My question is, do I sell the stocks which were on the 2022 list and not on 2023 list?

My plan is to add another $1,000 per new stock on the 2023 list & keep last years holdings, adding $1,000 to each. For example BNS is on both ‘22 & ‘23 list, I bought $1,000 of BNS in ‘22 and I’d like to add another $1,000 to BNS for this year & do the same for repeats on 2023 list, is that the way you do BTSX?

Hi Brett, thanks for the question. This comes up a lot. BTSX is a tool to identify potential investments. I stick rigidly to the method for the sake of data integrity – i.e. so we can trust the results year after year – but actually using the method on an individual level usually involves some flexibility. This post will probably be very helpful.

Thanks Matt, that post did help, hopefully you’ve mastered the art of the Table Saw 😉

Ha! – “mastered” may be too strong a word, but no more table saw mishaps for me! Just like in investing, a combination of mindfulness, caution and a little luck can do wonders.

Hey Matt, thanks for the annual update and Moneysaver sneak-peek! I have a question – I calculate my portfolio performance, and when figuring out the average yield, I’ve kept it simple and just use the current yield, i.e. for this year December 30 2022 the final trading day. But, with the AQN mishap….it doesn’t make sense to calculate in the whopping ~10% as that’s not what we all reaped during the entire year. So, do you use last year’s starting yield? Or some other method?

Thanks and all the best for 2023. Once again a great article that I will be sharing it around….

Chad

Good eye, Chad. I use the starting yield for both BTSX and the benchmark. I believe I adopted this method when I took over from David Stanley and Ross Grant in 2018 because that was how they did their calculations and I think consistency is important.

Because dividend raises during the year are not taken into account, however, and BTSX dividends typically go up more than the benchmark dividends, this means the calculations actually underestimate BTSX’s performance relative to the benchmark – but only slightly.

Hi Matt, I’ve been looking forward to the 2022 comparison and I appreciate the work you’ve done. What do you think of DRIP vs simply taking the dividend as cash?

Great question. DRIPs are great in registered accounts. In non-registered accounts they make tax time much more complicated because of ACB calculations – not worth it in my opinion.

Another good option is to use accumulated dividends to buy relatively undervalued stocks a few times throughout the year, thus doing some of your rebalancing proactively before year-end.

Still others will let the cash accumulate to use more tactically, waiting for buying opportunities. I have done this myself but have realized that I am better off investing that cash asap, rather than just letting it sit around.

Hi Matt,

I’ve been looking every day since January 2nd, but for some reason only saw your post today. Ahhh well. Better late, than never.

Good to see the BTSX beat your benchmark for another year.

Reading in the U.S. press that the Dogs of the Dow outperformed the DJIA for the first time since 2018. Never fails, when tech stocks underperform, like in the early 2000’s, value goes the opposite direction and shines. Been there, done that. Still waiting to see the performance results of the Dogs of the FTSE for 2022 over in Britain.

Yes, I’m invested in dividend paying stocks that fit the BTSX mold, but also in other than the normal four Canadian sectors. Three others to be exact. This year will mark the twentieth anniversary of slowly building up a personal diversified Canadian dividend paying company portfolio in the non-registered account. The previous twenty years to that it was more or less trying a little of this and a little of that. Somehow, I’ve survived where I can buy, sit, and hold in any type of market thrown at me. If a company doesn’t work out, I’m quite prepared to sideline it. I even occasionally sell, but not too often. Nothing sold this year. To be honest, I find it all easy peasy. I just keep the investing part in individual stocks really simple, just like the indexers do.

Glad you found the update, DividendsOn. Yes, BTSX did alright this year. Of course, whether or not the method helps individual investors achieve their goals is more important than the performance in any given year. It sounds like it is serving this function for both of us. I really like your last line and it’s the key to all of this: keep it simple, like index investing. That’s a great way to think about it.

Hi, thanks for the article. Is the data used for computing the long term returns of the strategy available? As I understand it both you and David Stanley tend to see btsx as somewhat flexible in terms of the buy/sell dates and the stocks themselves — i.e. it’s not a big deal when you buy the stock or how often you make purchases, and if a stock falls out of the top 10 list you wouldn’t necessarily sell it. However I believe when you are calculating the returns of the btsx you would be fairly rigid in these parameters. If the data isn’t publicly available is it possible for you to share the following variables that resulted in the returns described in the figure “Growth of $10,000: BTSX vs TSX60 Total Return:

1. The date where you would update the list of stocks to buy/sell (and is it just one time a year?)

2. If you immediately sell the stock once it falls out of top 10 or if you wait until the buy/sell date.

3. If you keep any stocks that fall out of the top 10.

Thanks!

Good questions! I recently updated the BTSX Results page to include the historical annual returns. You can find it here: https://dividendstrategy.ca/btsx-results/

To answer your questions:

1. The data is tracked based on selling/buying as of closing prices Dec 31st. Prior to 2002, David Stanley used May to May (this is noted on the table at the page linked above). The “Current BTSX” list is presented as a resource for investors who would like an up to date list at other times of year.

2. The method waits until year end. This is also what I do personally.

3. Yes, as long as they still fit within my investment plan. I try to keep emotions/predictions out of it.

Hope that helps!

Hi there,

With the recent dividend cut by AQN – would this remove it from the BTSX top 10 list?

Hi Bob, even with the cut, the yield is high enough to keep it in the top 10.